Here are some things I think I am thinking about. 1) Government spending staved off a much worse scenario. The inflation surge is sparking some heated discussions on the economy and the net benefit of the COVID stimulus. On the one hand, many things look great. On the other hand, inflation is hurting a lot of people more than this headline data makes it seem. My basic view is that the stimulus was worth it on the whole. I was very vocal about the risk of high inflation through all of 2020...

Read More »Everything’s Amazing and Nobody’s Happy

As I get older I am trying to do a better job of seeing both sides of all arguments so I am not tone deaf to the very real problems that a lot of people have, that all of us might not have. And here’s one that I hope you’ll help me out with because I don’t know if I have the right answers for it. Here are some interesting stats about the current state of affairs: GDP – all-time high Stock prices – all-time high Real estate prices – all-time high Household net worth – all-time high...

Read More »What if it’s All Going to Zero?

People often ask me: “What’s the point of owning bonds with interest rates so low?” I’ve heard this question for most of my career and while the risk profile of owning bonds has changed, they still serve the same purpose in a portfolio that they always have: To provide you with stability when you most need it (usually when the stock market is declining).¹ To provide you with some income that makes them superior safe haven assets when compared to cash. As I’ve explained before, this is as...

Read More »Everything You Need to Know About Inflation

Inflation is all the rage these days and it’s pretty much all I’ve been talking about lately. Here are some good resources I’ve produced in the last few weeks on the current inflation environment and how you can put it into the right perspective. Validea Podcast on inflation. We discuss: the various ways to measure it and how they are different the history of inflation in the US why quantitative easing didn’t cause inflation, but fiscal stimulus did the major forces that have kept...

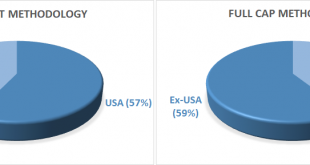

Read More »The US Stock Market is Not as Exceptional as We’ve Been Told

One of the interesting things about going through the process of building an asset management company is that you can get bogged down in the regulatory weeds about the meaning of specific words. I’ve discussed the general nature in which the finance and economic industries (mis)use terms like “money” or “passive investing” in ways that render them virtually meaningless. But the biggie I’ve come across more recently is the concept of “global stock market capitalization” – the total actual...

Read More »Three Things I Think I Think – Some Weekend Thinking

Here are some things I think I am thinking about: 1) The One Income Family is Never Coming Back. Here’s Blake Masters running on a platform for Arizona Senate that includes bringing back the one income family. You’ve probably heard or thought about this. The theory goes like this – American living standards are worse because it now takes two working parents to support a family as opposed to one income like the “good old days”. I think this narrative is somewhat backwards. Not only does...

Read More »Is Hyperinflation Coming?

Twitter lit up over the weekend when Jack Dorsey said that hyperinflation is coming. Dorsey is a very vocal advocate of Bitcoin and of course, also the CEO of two public companies, Square and Twitter. This is a pretty interesting prediction for a CEO of a large public company for several reasons: If he really believes what he said then he should, as a fiduciary to his shareholders, be advocating for far less USD exposure within his companies. Michael Saylor has developed the playbook for...

Read More »Get The Fed (and Government) Out of the Stock Market

The Federal Reserve has announced a sweeping set of strict rules to prohibit its employees from owning individual stocks, holding investments in individual bonds, holding investments in agency securities, or entering into derivatives. This is fantastic news following last week’s reports of rampant trading by Federal Reserve officials in recent years that create, at a minimum, the appearance of a conflict of interest. But these law changes do not go nearly far enough as the Fed remains far...

Read More »Did Bitcoin Kill Gold’s Monetary Utility?

I’ve always loved Harry Browne’s Permanent Portfolio. The concept is so simple and clean – own equivalent ratios of assets that protect you in an “all weather” fashion: 25% stocks for growth/expansions 25% bonds for income/deflations 25% cash/t-bill for liquidity/recessions 25% gold for inflation hedging This portfolio is a close approximation of a Global Market Portfolio. It’s simple, diverse and covers all the bases that we might expect to encounter across an economic cycle. It’s also...

Read More »R.I.P. – The Money Multiplier

Well, it took me 10 years to kill it, but I finally did it. I killed the money multiplier. I kid of course. I didn’t do it on my own.¹ It was a mass murder thanks to many of us. But regular readers will know that I have been on a sort of personal crusade to destroy this narrative for over a decade now. I have to admit. It put up a good fight and it was harder to kill than I would have expected. But it’s officially dead according to the Federal Reserve: It’s a weird feeling being so happy...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism