I’ll break this down into three things, but it’s really just one thing – war. 1) Is it time to panic? Here’s some good perspective of geopolitical conflicts and market returns over the last 75 years from Tom Morgan and BCA research (Tom is a great follow on Twitter by the way in case you don’t already). Long story short, this always causes short-term turmoil with the market generally falling at least 10% and then rebounding over the course of the coming year. Of course, this is an...

Read More »Is the Bond Bear Market Over?

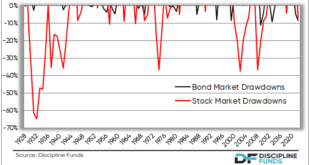

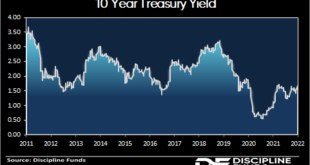

The Total Bond Market is down 5.5% from its 2021 peak. The 10 year T-Note is down 10.7% from its 2020 high. But with the market pricing in 7 rate hikes and inflation showing signs of topping it’s worth asking if the worst is behind us? I believe we’re getting close to the end of this bond bear market. I’ll explain why. 1) Bond bear markets are a totally different beast from stock bear markets. It’s become increasingly common to hear that we should abandon bonds in favor of stocks or other...

Read More »A Little Love for American Economic Data

Since it’s Valentine’s Day I might as well spend some time expressing thanks for my one true love – good data. I spend an exorbitant amount time compiling data. And I often feel very grateful to live in a country where data is transparent and abundant. And oh boy is it abundant. While there are numerous private data sources some of the very best data sources come from the US government. Consider just a few of the resources here that compile regularly updated data: I use most of these...

Read More »Three Things I Think I Think – All About Inflation

All I am thinking about is inflation these days. That’s it. 1) How about that CPI report? This morning’s CPI came in at 7.5%, hotter than expected. Not really that surprising. As I’ve been saying, we’re going to see a bunch of these high readings into the Summer. The statistical “topping effect” I’ve been talking about won’t start to really kick in until around June and then it should put a pretty likely top on the year over year data. If some prices fall (commodities and car prices) then...

Read More »MMT Failed Its First Big Inflation Test

Here’s a NY Times piece calling for a MMT “victory lap”, with an asterisk. It’s an interesting article, but the asterisk seems to be doing an awful lot of heavy lifting here. The basic gist of the article is that the government spent a lot of money and the government didn’t go broke. And sure, on the one hand, the economy is robust. On the other hand, inflation is worrisomely high. Depending on how you pick your narrative you can frame this as either very good or very bad. But does MMT...

Read More »Bitcoin is a Terrible Form of Money (but a Very Good Store of Value)

I have to put on my flame retardant suit for this one because the Bitcoin community is not going to like this. Here goes nothing. Most definitions of money say that money has to have three properties – unit of account, medium of exchange (MOE) and store of value (SOV). I think this definition is contradictory and the evidence of all financial assets through history bears this out. Stay with me for a few minutes. Money always has to be defined in a unit of account. That could be Bitcoin,...

Read More »What to do When the Market feels Crashy?

The Nasdaq is down 14%. The S&P 500 is down 9%. Even the gold standard of portfolios, the 60/40 is down 7%. They’re not catastrophic numbers, but they’re fairly sizable given that we’re only 27 days into the year. At this rate the Nasdaq will be at $0 by July. Just kidding. That’s not how that works. But still, it’s an uncomfortable environment. So what should we do? Here’s a quick check list: 1. Revisit your financial plan and goals. A lot of people will overreact during market...

Read More »Three Things I Think I Think – When Things Crash

Here are some things I think I am thinking about: 1) Grantham calls for a market crash. Here’s a provocative piece from Jeremy Grantham saying we’re in the 4th “superbubble” of the last century. I won’t ruin the uplifting read for you, but I will just say this – I don’t love making these sorts of huge extremist calls because this sort of emotionally charged rhetoric tends to lead people to make extreme portfolio moves. If you think a crash is around the corner then you move to 100% cash....

Read More »Three Things I Think I Think – Has Inflation Peaked?

Hope your long weekend is going well. Here are some things I think I am thinking about: 1) Has inflation finally peaked? I am ready to call it. Inflation has peaked or will peak in the coming few quarters. I’ve discussed the broader picture in the past (see this big piece for details), but the biggie here is an increasingly impactful statistical topping effect that is going to start putting downward pressure on the data in the coming quarters. Used cars are a great example of what’s been...

Read More »Who Will Buy the Bonds?

I like to emphasize that QE is a simple asset swap that happens after the primary asset issuance. That is, the government issues some amount of bonds when they run a deficit. And then the Central Bank implements QE by expanding their balance sheet by creating reserves and then swapping some quantity of those reserves for bonds. The private sector ends up holding more deposits and the Central Bank takes the bonds out of circulation. It is the logical equivalent of changing a savings account...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism