The surging popularity of Bernie Sanders in the 2016 Presidential election led to a substantial increase in the number of Democratic Socialists. The impact of this movement is real and we’re seeing it in recent elections with Alexandria Ocasio-Cortez winning a huge upset in New York. But what is Democratic Socialism and is this movement good for the country? Democratic Socialism is a political philosophy that advocates the social ownership of the means of production in a manner that is...

Read More »Inflation Update – Still Not Flatin’ Too Much

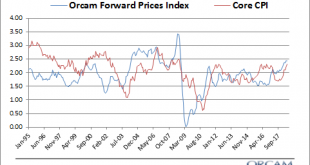

Back in February I provided a broad inflation update wherein I stated that core inflation was likely to tick higher from 1.8% to 2.3%. The June CPI report showed a core inflation rate of…2.3%. That remains a very low historical rate, but it’s been on the move higher in the last year. So now that we’re at my target from the beginning of the year – where to from here? Now, I know that forecasting is never a great idea. But it’s a necessary part of any good financial plan. And for me it helps...

Read More »Who Are the Greatest Investors of All-Time?

People are obsessed with the “greatest of all-time” for many reasons. The first reason is because we like to confirm our preconceived biases. For instance, if Tom Brady is the greatest QB in NFL history then it means that Boston has been one of the best places to live in the last 20 years.¹ Or, if Warren Buffett is the greatest investor of all-time then that means that your value investing strategy, as bad or good as it has been, has still been a smart strategy since that’s what Warren...

Read More »Let’s Talk About that “Rapidly” Falling Deficit

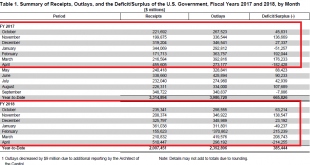

Here’s an interview of Larry Kudlow, National Economic Council Director, saying that the deficit is “coming down rapidly”. I don’t know why he’s saying this because it’s not remotely true and there’s no reason for him to shy away from the rising deficit. The US Treasury’s Monthly Treasury Statement clearly shows the deficit is rising. The deficit is UP 12% this year versus the same period last year. Here it is in black and white: Now, the really interesting thing is why this is happening....

Read More »How Blogging Changed Wall Street

I just got back from the Evidence Based Investing conference hosted by Ritholtz Wealth and IMN in beautiful Dana Point, California. One of the persistent themes at the event was the importance of social media and blogging. Basically, those of us who are being super transparent online are providing a totally different client facing experience than the old school brokers and advisors who mainly use their firm’s brand name to attract clients and prove their value. Blogging totally changed...

Read More »5 Questions and Answers on “Passive” Investing, Part Deux

Here’s part two of the Q&A on passive investing. If you haven’t read part 1 it will be helpful to do that first since I laid out the necessary definitions and foundation for a clear discussion. I answered Marks’ first question about passive investing in the first post, but as it was running a little long I didn’t get to the next four. So let’s bang those out: Question 2: “What are the implications of passive investing for active investing?” Marks goes on to specifically ask: “what...

Read More »5 Questions and Answers on “Passive” Investing

If you have read my 2012 essay on “The Myth of Passive Investing” then you probably don’t need or want to read what’s below. If there’s a consistent theme on this website it’s that I am trying to establish a consistent taxonomy and set of understandings of financial concepts so that people can better navigate the monetary world we live in. Sadly, finance and economics is filled with words that are used in such a general manner that they have virtually no meaning. For instance, the word...

Read More »Trump’s Fascinating Economic Experiment (That Might Just Be Working)

Warning – I am going to get a little bit political here so try not get your panties in a bunch over these comments. I am trying to be objective and apolitical which is becoming an increasingly difficult thing to do these days. That said, I want to be clear that I don’t like Donald Trump personally. I think he’s actually a bad person. Still, I think some of his economic ideas are very interesting. When I said that Donald Trump would likely win the Presidency back in 2016 I was mainly...

Read More »The Fall of GE and the Rise of Indexing

Something important is happening to corporations these days – they aren’t living as long as they used to. According to researchers at Dartmouth a public company listed before 1970 had a 92% change of being around in 5 years versus just a 63% chance for companies listed in the 2000’s (the study controlled for the financial crisis). Companies are dying faster than they ever have. This is interesting in the context of General Electric’s removal from the Dow because GE is one of the ultimate...

Read More »EBI West Conference!

Just a FYI here – I am speaking at this weekend’s EBI West conference organized by Ritholtz Wealth. This is one of the best investment conferences of the year. You won’t be disappointed if you attend. Last year I drank 10 margaritas in the pool and still won the competition for the speaker who did the best underwater handstand. I don’t remember my talk after all that, but I can assure you it was great. Just kidding. I can’t drink 10 margaritas. Not because I don’t want to (I do), but...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism