If, as a result of Brexit, the economy crashes it will not vindicate the economists, it will simply illustrate once more their failure. We, at Policy Research in Macroeconomics (PRIME) call for an urgent, independent, public inquiry into the economics profession, its role in precipitating both the financial crisis of 2007-9, and the subsequent very slow ‘recovery’. Finally the role of the profession in the run up to the British European referendum campaign. As this morning illustrates,...

Read More »A political and economic case for voting to Remain

The case for Britain to Remain within the EU is to my mind, largely a political case. The political forces pressing for a rupture with the Union are not on the whole progressive, although there are many sincere Leave campaigners on the Left of the spectrum. ‘Brexiters’ are mostly insular, nationalistic and sometimes racist, especially in relation to immigrants and refugees. With few exceptions the Brexit leaders are market fundamentalists, anxious to blame foreigners for the state of...

Read More »Uber, Newsnight and Donald Trump

I fluffed my lines on a recent BBC Newsnight segment on Uber. As the discussion was wrapping up, I warned that the uberisation of the economy – the ambition to corral the entire cash flow of whole sectors of the global economy into the pockets of a few – is utopian. I said all this in response to Ms Julie Meyer’s assertion that, and I quote (11.23 minutes into the show): The world is being driven by networks…and they’re platforms…That’s the future, we can’t stop that from happening....

Read More »Mohammed Ali: “never give up fighting racism”

Mohammed Ali – ‘The Greatest’ – died today, at the age of 74. With his loss, the world is deprived of the terrific energy of a principled, devout and committed man. A boxer, a philosopher and a poet. But for those of us who worked hard to achieve the cancellation of about $100 billion of debt for thirty five of the poorest countries, Ali occupies a special place in our hearts. This great man, celebrated around the world, took time out to join us in London in 1999, and to give his backing to...

Read More »Why I will vote Remain

Back in 1975 I did not just oppose membership of the EU, I actively campaigned against it. In the 1990s I strongly opposed Britain’s membership of the Exchange Rate Mechanism (ERM). My opposition to the Labour leadership’s support for ERM helped ensure that I did not get chosen as Parliamentary candidate at the time. I won a modest 6 votes at a General Committee Meeting that in 1991 selected the next MP for Dulwich and West Norwood! (While I was to be vindicated by Britain’s eviction from the...

Read More »The Green New Deal Framing: the Economic Narrative

April 8th, 2016 On Thursday 7th April Ann Pettifor took part in one of John McDonnell’s road shows with Professor Simon Wren Lewis. The events are aimed at broadening the debate around economics in Britain. Ann discussed The case for the Green New Deal, and her powerpoint presentation is attached below. Framing the Economic Narrative

Read More »Mr Osborne and the economists’ advice

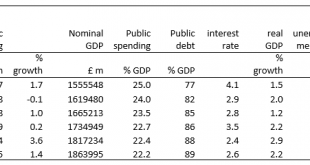

From the March 2016 Preface to The Economic Consequences of Mr Osborne By Ann Pettifor, Professor Victoria Chick and Geoff Tily … when sustained, fiscal consolidation increases rather than reduces the public debt ratio and is in general associated with adverse macroeconomic conditions. ‘Economic Consequences of Mr Osborne’, June 2010 Having missed the genuine threat of the private debt bubble, the economics profession misread disastrously the increase in public debt. In their 2009 This Time...

Read More »The boom, not the slump, is the time for austerity – Guardian Letters

The following is a letter by Professor John Weeks and Ann Pettifor, published today, 15th March 2016 in The Guardian. Andrew Harrop’s article on John McDonnell’s public borrowing for investment points out its improvement on the chancellor’s deficit obsession (John McDonnell’s new fiscal rule is strong, but it’s no election winner, theguardian.com, 11 March). Of particular concern is George Osborne’s determination to “balance the books” by cutting current spending on the disabled. To...

Read More »Threat of a synchronised downturn & G20 Finance Ministers’ complacency

OECD secretary general Jose Angel Gurria, US Federal Reserve chair Janet Yellen and British chancellor of the exchequer George Osborne chat during a G20 photocall. Photograph: Rolex Dela Pena/AFP/Getty Images “For the proposition that supply creates its own demand, I shallsubstitute the proposition that expenditure creates its own income” JM Keynes Collected Writings, Volume XXIX, p. 81 G20 Finance Ministers met in Huangzhou, China recently and refused appeals from both the IMF and...

Read More »Numb and number: where The Big Short falls short

Christian Bale as perspicacious hedge-fund manager Michael Barry in The Big Short (2015) First published (as a slightly edited version of the original, below) in the BFI Sight and Sound Magazine, 28 February 2016. As this goes to press, global capital markets appear to be stabilizing after another period of intense, and scary stock market volatility. This set the context for the arrival in Britain of Adam McKay’s The Big Short – a film about the American sub-prime mortgage meltdown, based on...

Read More » Ann Pettifor: Debtonation

Ann Pettifor: Debtonation