from Dean Baker In the last four decades, US policymakers have taken major steps to strengthen and lengthen patents, copyrights, and other forms of intellectual property (IP). The normal duration of patents and copyrights have been extended, and patents have been expanded to cover life forms, software, and business methods. This strengthened IP regime has been supported by both political parties and has gone largely unquestioned in public debate. That’s unfortunate, because there is an...

Read More »Bottom line

from David Ruccio The business press is having a hard time figuring out this one: the combination of unrelenting drama in and around Donald Trump’s White House and the stability (signaled by the very low volatility) on Wall Street. As CNN-Money notes, One of the oldest sayings on Wall Street is that investors hate uncertainty. But that adage, much like other conventional wisdom, is being challenged during the Trump era. Despite enormous question marks swirling around the fate of President...

Read More »Chicago economics — a dangerous pseudo-scientific zombie

from Lars Syll Every dollar of increased government spending must correspond to one less dollar of private spending. Jobs created by stimulus spending are offset by jobs lost from the decline in private spending. We can build roads instead of factories, but fiscal stimulus can’t help us to build more of both. This form of “crowding out” is just accounting, and doesn’t rest on any perceptions or behavioral assumptions. John Cochrane What Cochrane is reiterating here is nothing but Say’s...

Read More »Europe’s third alternative: leapfrogging Putin

from Robert Locke One big problem in orthodox economics is the inability of its market orientation to cope with strategic implications of economic and political geography. I pointed that out in an article published in the rwer (“Reassessing the basis of economics: from Adam Smith to Carl von Clausewitz,” #61, 26.09.2012, 100-114), to which nobody responded. But the issue won’t go away and is especially pertinent today, because of the uproar caused by Trump’s failure to support the...

Read More »Trump and the Neocons: doing the unilateralist waltz

from Thomas Palley The neocon factor dramatically changes the interpretation of the Trump administration’s unilateralist international economic policy chatter. Donald Trump’s first one hundred days have revealed his inclination for unilateralism in international relations. That inclination reflects his opportunistic and bullying disposition, and it also fits well with his anti-globalization pose. Trump’s unilateralism has also spawned a dangerous waltz with Washington’s neocon...

Read More »Modern economics — pseudo-science based on FWUTV

from Lars Syll The use of FWUTV — facts with unknown truth values — is, as Paul Romeer noticed in last year’s perhaps most interesting insider critique of mainstream economics, all to often used in macroeconomic modelling. But there are other parts of ‘modern’ economics than New Classical RBC economics that also have succumbed to this questionable practice: Statistical significance is not the same as real-world significance — all it offers is an indication of whether you’re seeing an...

Read More »The 10 most viewed RWER Blog posts in 2016

Poll Results: Top 10 economics books of the last 100 years Summary of the Great Transformation by Polanyi Asad Zaman Reflections on the “Inside Job” Peter Radford The tiny little problem with Chicago economics Lars Syll Money and the myth of barter David Ruccio What is Post Keynesian Economics? Lars Syll The seven countries most vulnerable to a debt crisis Steve Keen The 15 largest arms exporters per capita Joseph Buzaglo Re-thinking the definition of...

Read More »Neoliberalism — an oversold ideology

from Lars Syll So what’s wrong with the economy? … A 2002 study of United States fiscal policy by the economists Olivier Blanchard and Roberto Perotti found that ‘both increases in taxes and increases in government spending have a strong negative effect on private investment spending.’ They noted that this finding is ‘difficult to reconcile with Keynesian theory.’ Consistent with this, a more recent study of international data by the economists Alberto Alesina and Silvia Ardagna found...

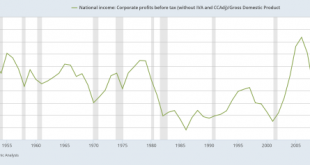

Read More »Making corporate taxes great again

from David Ruccio I continue to maintain that Congressional Republicans will stick with President Donald Trump until they get their favorite policies enacted—or until Trump’s missteps and declining popularity stand in the way of their getting what they want. And one of the things they want is tax reform—specifically, a cut in corporate taxes. Here’s the problem: U.S. corporations aren’t taxed too heavily. They’re taxed too little. As is clear from the chart above, corporate profits (as a...

Read More »Econometrics? Keep it very simple.

Readers of this blog might have noticed that I prefer to detrend time series using a moving average – and not the advanced and routinely and widely used Hodrick-Prescott filter. Part of this was lazyness. But I also do not like the HP filter: what is it? Why does it wag its tails so much? What is the ‘right’ smoothing parameter? James D. Hamilton has answered my questions (while implicating that loads of research is at least suspect if not worthless): Why You should never use the...

Read More » Real-World Economics Review

Real-World Economics Review