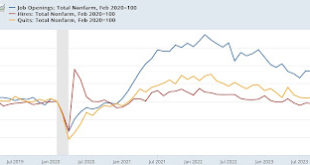

– by New Deal democrat After almost half a year of general stabilization, or very slow deceleration, the JOLTS report for March featured multi-year lows in almost all of its components. Job openings (blue in the graph below), a soft statistic that is polluted by imaginary, permanent, and trolling listings, declined -325,000 to a three year low of 8.488 million. Actual hires (red) declined -281,000 to 5.500 million, the lowest level since the...

Read More »Manufacturing treads water in April, while real construction spending turned down in March (UPDATE: and heavy truck sales weren’t so great either)

by New Deal democrat The Bonddad Blog A preliminary programming note: In addition to the manufacturing and construction reports, today we also get the JOLTS report for March, and updated motor vehicle sales reports. Yesterday we also got the Employment Cost Index for Q1. I will comment on the JOLTS report later today. I’ll comment on the ECI along with jobless claims tomorrow. Additionally, Wolf Richter made an interesting point yesterday...

Read More »Repeat home sale prices accelerated in February (but don’t fret yet)

– by New Deal democrat The Bonddad Blog Our final housing statistics of the month are the FHFA and Case Shiller repeat sales indexes. As usual, keep in mind that mortgage rates lead home sales, which in turn lead prices. Which, in turn, lead the official CPI measure of shelter by a year or more. This morning the FHFA purchase only price index through February spiked a sharp 1.2% (!) on a seasonally adjusted monthly basis, causing the YoY...

Read More »Looking at historical “mid cycle indicators” – what do they say now?

– by New Deal democrat The Bonddad Blog About 10 years ago, I went looking for what I called “mid cycle indicators.” In other words, I wanted to go beyond leading or lagging indicators to find at least a few that tend to peak somewhere near the middle of an expansion. That synapse was jangled when I read the title of a recent update by financial analyst Cam Hui, “Relax, it’s just a mid-cycle expansion.” Since I hadn’t looked at the...

Read More »Why Isn’t The USA in a recession ?

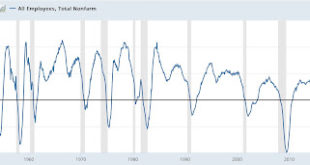

Oddly I am back here posting. Even more oddly I am posting on the topic I am paid to address. I start by noting two things. About one year ago, many macroeconomic forecasters predicted that a recession would have started by now in the USA. I forget who placed the probability at 100%. In spite of sltightly disappointing 0.4% (1.6% if annualized) real GDP growth in the first quarter of 2024, we are not in a recesion. What went right ? The...

Read More »New Deal democrats Weekly Indicators for April 22 – 26

– by New Deal democrat The Bonddad Blog My “Weekly Indicators” post is up at Seeking Alpha. Not much churn in the short leading or coincident timeframes this week. But one of the long leading indicators joined the “less bad” parade. This is what I would expect to see coming out of a recession, before growth in the shorter term improves. Just one week, but still . . . As usual, clicking over and reading will bring you up to the virtual...

Read More »Protesting Now and in the Sixties and Seventies

You gotta be old enough to remember what took place in the sixties and into the seventies with regard to protesting. In 1970 when I was bathing in and drinking the Camp Lejeune water, we were selected to be trained in riot control. JIC the protestors, the student protesters were a bit rambunctious in Washington D.C. All the better we were not called out. Still the same fears we are seeing today on college campuses. Similar right-wing dialogue by...

Read More »Another strong personal income and spending report, but beware the uptick in inflation

– by New Deal democrat The Bonddad Blog Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services...

Read More »Governor Katie Hobbs Announces $500K in FAFSA Initiatives to Assist Arizona Families Afford College

According to The Hill the New FAFSA forms were supposed to be easier and shorter. Shorter yes, nut not so easy. There is a list of 2024-24 FAFSA issues which are confounding parents and students attempting to complete the FAFSA so as to be eligible for student aid. FAFSA forms were changed in 2023 and were supposed to be available in October 2023. Availability was delayed till December 2023. When finally released there were complications with the...

Read More »Leading indicators in the Q1 GDP report are mixed

– by New Deal democrat The Bonddad Blog Most of the commentary you will read about Q1 GDP that was released this morning will be about the core coincident components. For that I will simply outsource to Harvard’s Prof. Jason Furman: “much of the slowdown was in non-inertial items like inventories (-0.35pp) and net exports (-0.86pp). The better signal of final sales to private domestic purchasers was 3.1%.” I agree. With that out of...

Read More » Heterodox

Heterodox