I know that lots of you are heartily sick of the WASPI campaign, but it does have a tendency to throw up interesting issues. This time, it is the legal status of the UK's state pension.A couple of days ago, the WASPI campaign announced a crowdfunding campaign to raise funds for legal action against the Government. Their CrowdJustice page says that legal action would potentially be twofold: (this is a screen print from the CrowdJustice page. Regular readers of my blog will be aware that I...

Read More »The dominance of Brexit

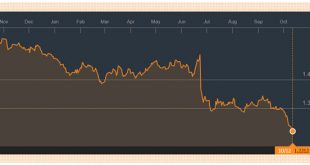

Some people have been saying that sterling's fall has nothing to do with the Brexit vote. Sterling was already falling before the vote, they say, because of the UK's wide and growing current account deficit. So I thought I would fact check this.Here is the UK's current account deficit since 1987, courtesy of ONS: Well, ok, it has rarely been anywhere near balance in the current century, and it has been trending downwards since 2011.Now let's look at sterling. Here is sterling's...

Read More »The currency effects of Brexit

Sterling is falling. Predictably, the financial press describe its slide as a "pounding" and gleefully tell us that sterling is the worst-performing currency after the Argentinian peso.But some people are cheering. Falling sterling is good for exports, isn't it? So if the pound keeps falling, the UK's large trade deficit will start to shrink, reducing the UK's dependence on external financing and hence its vulnerability to a "sudden stop".Sadly, it's not that simple. Falling sterling is not...

Read More »Why is global trade so weak?

Global trade is awful. Really, it is. For the last five years, trade volumes have been growing at their slowest sustained rate since the early 1980s. Here's a horrible chart from the World Trade Organisation's latest forecast: And in the last year, things have got worse: Import demand of developing economies fell 3.2% in Q1 before staging a partial recovery of 1.5% in Q2. Meanwhile, developed economies recorded positive import growth of 0.8% in Q1 and negative growth of -0.8% in Q2....

Read More »A dent in the surface of time

This chart has been fascinating me for ages. It was produced by the Bank of England to illustrate a speech by Andy Haldane. Shock, horror - we have the lowest interest rates for 5,000 years. Even in the Great Depression they were higher than they are now. These are, of course, nominal interest rates. Real interest rates are even lower - though not by much, since inflation is close to zero in all major economies.Note also the divergence of long-term and short-term interest rates. This is...

Read More »Some unpleasant trade realities

Well, this is fun. YouGov has asked the public which countries the UK's new trade negotiators (if and when they are recruited) should prioritise in their quest for free trade deals.Unsurprisingly, the US and the EU (considered as a whole trading bloc) came top of the list. But as ever, the devil is in the detail. These charts show the difference between the public's perception of the importance of a country versus its exports and GDP rankings: Now, of course the exports ranking is the...

Read More »Are inheritance taxes unfair?

Are inheritance taxes unfair? Many people think they are. "Why should I be taxed twice on money I've earned during my lifetime?" they say. This is, of course, a fallacy. Dead people don't pay taxes. Living ones do. So inheritance tax is not double taxation of money the dead person earned while they were still alive. It is taxation of an unearned windfall for the people to whom they leave their assets, usually their children. Other forms of unearned income, such as interest on...

Read More »Austerity and the rise of populism

This post has been brewing for a long time. It reflects my attempt to make sense of the growing political confusion and chaos in the world today. William Butler Yeats's poem The Second Coming well expresses what I see: Things fall apart; the centre cannot hold; Mere anarchy is loosed upon the world, The blood-dimmed tide is loosed, and everywhere The ceremony of innocence is drowned; The best lack all conviction, while the worst Are full of passionate intensity. But how have we come to...

Read More »Maslow’s hierarchy of money

A new study shows that the form of shadow "money" used in US prisons is changing. For many years it has been cigarettes (tobacco), and to a lesser extent stamps and envelopes. But now it seems the popularity of these in the prison black economy is declining - in favour of food. Specifically, Ramen noodles, a high-calorie, substantial foodstuff.Without examining the reasons for this change, it would be easy to assume that this is a matter of relative scarcity. Perhaps Ramen noodles are...

Read More »No, please don’t show me your model

Unsurprisingly, on my post "The Art of Economics", which attempted to put the mathematical models beloved of mainstream economics firmly in their place, is a comment defending mainstream mathematical models. Here it is, in part: Secondly, you definitely don't need obscure heterodox models to predict a financial crisis. I've cited it before, but for instance Kiyotaki-Moore basically sketches out how a crisis like this can occur. There are actually plenty of examples of perfectly fine...

Read More » Francis Coppola

Francis Coppola