Treason is popular. As the tide of protectionism rises around the world, the concept has come back into vogue. If you believe in the right of all people, whatever their colour or creed, to seek life, liberty and happiness for themselves and their children, you are unpatriotic. I am one of many who have been labelled a "traitor" for voting Remain in the EU referendum. But I have got off lightly. The same label cost Jo Cox MP her life.Jo was a fervent Remain supporter. She believed strongly...

Read More »Reinventing work for the future

We have a crisis of work. The secure, well-paid jobs of the past - many of them in manufacturing - are disappearing. What is replacing them is insecurity and uncertainty. Low-paid, part-time, temporary and seasonal work. The "feast or famine" of self-employment. The so-called "sharing economy", where people rent out their possessions for a pittance. The "gig economy", where people are paid performance by performance - or piece by piece. "Piecework", we used to call it. Perhaps we...

Read More »The dangerous scheming of stupid politicians

There is growing speculation that the Governor of the Bank of England, Mark Carney, will not extend his term. Carney originally agreed to a five-year term, which would end in 2018, but it had been thought he might extend to the more usual eight years for a Bank of England governor. This is now looking increasingly unlikely.Carney has come under fire from pro-Brexit politicians for warning that Brexit is likely to increase inflation and unemployment and reduce economic growth. They...

Read More »Raising interest rates is not that simple, Lord Hague

The present period of very low interest rates is widely assumed to be temporary, a consequence of the 2008 financial crisis and subsequent central bank action. Because of this, as the financial crisis fades into the mists of time, there is growing political pressure for "normalisation" of interest rates. Here, for example, is William Hague warning that central banks must start to raise rates or face losing their independence: The only way out is for the US Fed to summon the courage to lead...

Read More »State pensions: property right or benefit?

I know that lots of you are heartily sick of the WASPI campaign, but it does have a tendency to throw up interesting issues. This time, it is the legal status of the UK's state pension.A couple of days ago, the WASPI campaign announced a crowdfunding campaign to raise funds for legal action against the Government. Their CrowdJustice page says that legal action would potentially be twofold: (this is a screen print from the CrowdJustice page. Regular readers of my blog will be aware that I...

Read More »The dominance of Brexit

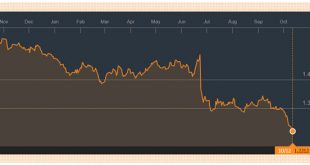

Some people have been saying that sterling's fall has nothing to do with the Brexit vote. Sterling was already falling before the vote, they say, because of the UK's wide and growing current account deficit. So I thought I would fact check this.Here is the UK's current account deficit since 1987, courtesy of ONS: Well, ok, it has rarely been anywhere near balance in the current century, and it has been trending downwards since 2011.Now let's look at sterling. Here is sterling's...

Read More »The currency effects of Brexit

Sterling is falling. Predictably, the financial press describe its slide as a "pounding" and gleefully tell us that sterling is the worst-performing currency after the Argentinian peso.But some people are cheering. Falling sterling is good for exports, isn't it? So if the pound keeps falling, the UK's large trade deficit will start to shrink, reducing the UK's dependence on external financing and hence its vulnerability to a "sudden stop".Sadly, it's not that simple. Falling sterling is not...

Read More »Why is global trade so weak?

Global trade is awful. Really, it is. For the last five years, trade volumes have been growing at their slowest sustained rate since the early 1980s. Here's a horrible chart from the World Trade Organisation's latest forecast: And in the last year, things have got worse: Import demand of developing economies fell 3.2% in Q1 before staging a partial recovery of 1.5% in Q2. Meanwhile, developed economies recorded positive import growth of 0.8% in Q1 and negative growth of -0.8% in Q2....

Read More »A dent in the surface of time

This chart has been fascinating me for ages. It was produced by the Bank of England to illustrate a speech by Andy Haldane. Shock, horror - we have the lowest interest rates for 5,000 years. Even in the Great Depression they were higher than they are now. These are, of course, nominal interest rates. Real interest rates are even lower - though not by much, since inflation is close to zero in all major economies.Note also the divergence of long-term and short-term interest rates. This is...

Read More »Some unpleasant trade realities

Well, this is fun. YouGov has asked the public which countries the UK's new trade negotiators (if and when they are recruited) should prioritise in their quest for free trade deals.Unsurprisingly, the US and the EU (considered as a whole trading bloc) came top of the list. But as ever, the devil is in the detail. These charts show the difference between the public's perception of the importance of a country versus its exports and GDP rankings: Now, of course the exports ranking is the...

Read More » Francis Coppola

Francis Coppola