This is a very good lecture by John Burbank of Passport Capital. I particularly like his explanation of prices: “Price is all the information that exists in the market…it’s just what people think….price means nothing other than the equilibrium of liquidity…It doesn’t mean it’s good or bad, it’s just where people agree.” That’s really clean thinking. And it’s very different from something like the efficient market hypothesis which says that all available information is reflected in...

Read More »Thinking About Net Financial Assets (Nerdy)

Steve Waldman has a very good post over on his site about the concept of “net financial assets” and the way it is used by some economists (mainly MMT economists). Several of us covered this in excruciating detail several years ago when we had our big disagreements with the MMT people, but it’s always worth going over again because it’s an important concept in financial accounting. For those who aren’t familiar, “net financial assets” refers to private sector assets issued by the public...

Read More »So Long, Rate Hikes!

The emerging market turmoil that developed this year was a total game changer for Fed policy. Even though the US economy looked relatively strong (I’d argue it has been muddling through all along) the argument in favor of rate hikes shifted once the foreign economy started to falter. Especially when we started hearing about how much turmoil the rising dollar was causing in commodity markets and economies that had borrowed in dollar denominated instruments. The risk of raising rates in...

Read More »Three Things I Think I Think: Trumponomics Edition

Here are some things I think I am thinking about: 1) Trumponomics – a bi-partisan dream come true? Donald Trump has only just started to offer details on his economic plan and I have to admit that I am intrigued. He’s essentially calling for across the board income tax cuts, closing the carried interest loophole, taxing importers and boosting spending on infrastructure and the military. There haven’t been a lot of details here, but so far it sounds like the spending cuts would be wildly...

Read More »How Long Can You Stick With Failing Factor Investing?

Someone asked me the other day why I reject factor investing. My answer was simple. I said that factor investing is usually just a good marketing pitch to charge higher fees for something that will give you most of the correlation of a market cap weighted portfolio. For the uninitiated, factor investing is one of the hot buzz words in portfolio construction these days. Researchers found that “risk” doesn’t properly describe what drives returns over the long-term and several other factors...

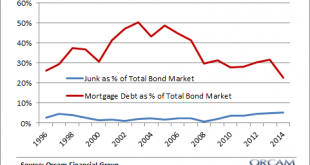

Read More »Is the Junk Bond Market the Next 2008?

Recency bias is a real sonofabitch. After someone goes through a traumatic experience they tend to be shocked into believing that the next big traumatic experience is right around the corner. But the reality is that outlier events are outlier events for a reason – they don’t happen nearly as often as we expect. For instance, I was in a car accident this past weekend. I was driving in one of these wonderful ride sharing programs when a car sideswiped us blowing through a stop sign. I was...

Read More »Did the Fed Cause the Commodity Bubble?

I spent an inordinate amount of time back in 2010 & 2011 talking about the potential for a commodity bubble that was Fed induced (see here, here and here). It’s now clear that the commodity collapse is rippling through many financial markets and it’s only a matter of time before the blame game starts here. I figured I’d go ahead and start pointing fingers before we even have a real crisis on our hands. The three big players in the commodity boom were clearly China, Wall Street and the...

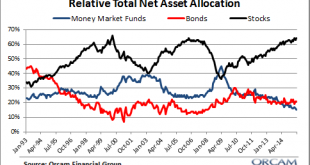

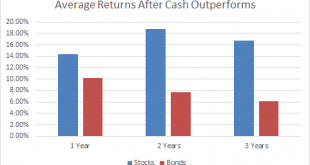

Read More »The Cash is King Playbook

We’re seeing something really unusual in the financial markets this year. As I’ve noted recently, there’s almost nothing that’s working this year. No matter where you’ve diversified your savings you’ve likely lost money with the exception of cash. If we look at the two primary asset classes, stocks and bonds, cash has only outperformed both in the same year 10 times in the last 90 years. So this is a pretty unusual event. But there’s some potential good news on the horizon. When this...

Read More »Random Thing I Think I Think: Gambling, Investing, Luck & Skill Edition

Have you seen the commercials for fantasy sports gambling leagues like FanDuel or DraftKings? They’re everywhere. In case you’ve been in your bunker waiting for China to implode the global economy – these are basically ways of gambling on sports via the label “fantasy sports”. These firms are raking in huge amounts of money through a legal loophole that differentiates between sports gambling and gambling on fantasy sports based on the idea that fantasy sports involves “skill”. The wise...

Read More »Yellen Fears the Boom & not the Bust

Janet Yellen offered some more details behind her thinking on future Fed policy at a speech this evening. Here’s the key section: Given the highly uncertain nature of the outlook, one might ask: Why not hold off raising the federal funds rate until the economy has reached full employment and inflation is actually back at 2 percent? The difficulty with this strategy is that monetary policy affects real activity and inflation with a substantial lag. If the FOMC were to delay the start of the...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism