from Lars Syll Ce qui fait l’unité de la discipline est plutôt l’identification causale, c’est-à-dire un ensemble de méthodes statistiques qui permettent d’estimer les liens de cause à effet entre un facteur quelconque et des résultats économiques. Dans cette perspective, la démarche scientifique vise à reproduire in vivo l’expérience de laboratoire, où l’on peut distinguer aisément la différence de résultat entre un groupe auquel on administre un traitement et un autre groupe semblable...

Read More »Modern money and inflation

from Asad Zaman Milton Friedman was a powerful magician. His words charmed people into believing that night was day, against the evidence of their own eyes. Friedman’s maxim that “inflation is everywhere and always a monetary phenomenon” is widely believed by economists, even though it is abundantly obvious that costs of production, especially energy costs, play a major role in creating inflation. Pinochet meets Friedman (STF/AFP/Getty...

Read More »Sam Bankman-Fried’s truly effective philanthropy: teaching

from Dean Baker We should all recognize that Sam Bankman-Fried is much smarter than the rest of us. After all, outwardly he looks to be one of the biggest frauds of all time. By the age of 30 he amassed a fortune that dwarfs that of your average billionaire. He did it by running a crypto Ponzi-scheme. While claiming to be using his wealth to support philanthropies that were carefully selected to maximize human welfare, he was actually living a high life-style with his friends. Now that...

Read More »On models and simplicity

from Lars Syll When it comes to modelling yours truly does see the point emphatically made time after time by e. g. Paul Krugman about simplicity — at least as long as it doesn’t impinge on our truth-seeking. ‘Simple’ macroeconomic models may of course be an informative heuristic tool for research. But if practitioners of modern macroeconomics do not investigate and make an effort of providing a justification for the credibility of the simplicity assumptions on which they erect their...

Read More »The pandemic treaty, crypto, and inequality

from Dean Baker The World Health Organization is in the early phases of putting together an international agreement for dealing with pandemics. The goal is to ensure both that the world is prepared to fend off future pandemics by developing effective vaccines, tests, and treatments; and that these products are widely accessible, including in low-income countries that don’t have large amounts of money available for public health expenditures. While the drafting of the agreement is still in...

Read More »Macroeconomics and the Friedman-Savage ‘as if’ logic

from Lars Syll An objection to the hypothesis just presented that is likely to be raised by many … is that it conflicts with the way human beings actually behave and choose. … Is it not patently unrealistic to suppose that individuals … base their decision on the size of the expected utility? While entirely natural and under- standable, this objection is not strictly relevant … The hypothesis asserts rather that, in making a particular class of decisions, individuals behave as if they...

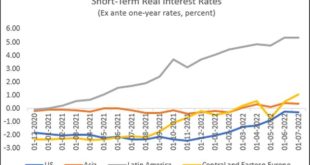

Read More »The monetary policy fallout for developing countries

from C.P. Chandrasekhar and Jayati Ghosh The monetary policies of the major advanced economies have been obsessively nationalist for more than two decades now, with hardly any genuine international cooperation beyond some coordination among G7 economies. These policies in turn have had all sorts of impacts—often very negative—in the rest of the world, and particularly in the low and middle income countries referred to collectively as emerging and developing economies (EMDEs). After the...

Read More »CRYPTO MELTDOWN is a great time to eliminate waste in bloated financial sector

from Dean Baker I remember talking to a progressive group a bit more than a decade ago, arguing for the merits of a financial transactions tax (FTT). After I laid out the case, someone asked me if we had lost the opportunity to push for an FTT, now that the financial crisis was over. I assured the person that we could count on the financial sector to give us more scandals that would create opportunities for reform. Shortly thereafter, we were rewarded with the trading scandal from the...

Read More »The dangers of using unproved assumptions

from Lars Syll The unpopularity of the principle of organic unities shows very clearly how great is the danger of the assumption of unproved additive formulas. The fallacy, of which ignorance of organic unity is a particular instance, may perhaps be mathematically represented thus: suppose f(x) is the goodness of x and f(y) is the goodness of y. It is then assumed that the goodness of x and y together is f(x) + f(y) when it is clearly f(x + y) and only in special cases will it be true...

Read More »Monies

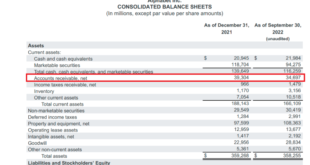

What’s money? Wrong question. The right question: ‘which kinds of monies do we use for which purposes?’ as there are different kinds of money which are used for different purposes. Here, I want to stress that ‘receivables’ are: money. And are, at the moment, mainly used for inter-company purchases. The quarterly balance sheets (below) of Alphabet (formerly Google) show that, as of September 2020, Accounts Receivable had a value of almost 35 billion dollar. Accounts receivable are...

Read More » Real-World Economics Review

Real-World Economics Review