Whoa!… hold up!… was Marx correct? 🤔Americans are increasingly voting along class lines, not racial ones. That could upend how we’ve thought about politics for decades. https://t.co/rWBJFK32BD— The Wall Street Journal (@WSJ) November 15, 2024

Read More »Articles by Mike Norman

Episode 8 (S2) of the Smith Family Manga is now available — Bill Mitchell

2 days agoToday (November 15, 2024), MMTed releases Episode 8 in the Second Season of our Manga series – The Smith Family and their Adventures with Money. Have a bit of fun with it while learning Modern Monetary Theory….William Mitchell — Modern Monetary TheoryEpisode 8 (S2) of the Smith Family Manga is now availableBill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Read More »Oh no…Eva Langoria leaving the U.S.!!!

2 days agoOh no, what will we do? "Privileged" (her words) Eva Langoria is leaving the U.S.!! What a loss. Here’s Eva, lamenting for all the rest of us who will be left behind.“Most Americans” are “going to be stuck in this dystopian country, and my anxiety and sadness is for them."Thank you, Eva, for your fake concern. We’ll try to get by in this terrible country as best as possible. But before you go, can you please take all of your Hollywood asshole friends, too? America can’t stand you and your privileged elitist sanctimonious jerks from Tinseltown. Get lost. Go!! Hopefully, this is not an empty threat by Eva, as we hear regularly from people like Alec Baldwin, Susan Sarandon, and Robert De Niro. They should take the lying, terrorist-loving, woke, anti-American mainstream media with them.

Read More »Wishful Thinking

5 days agoMore wishful thinking from Democrat left:Given voters’ ire at the high cost of living, it might be wrong to assume Donald Trump will simply pick up where he left off and pressure the Fed to take interest rates right on down https://t.co/Mf70bunUQr— Bloomberg Economics (@economics) November 12, 2024

Read More »Trump v Iran

8 days agoReports Iran conspired to assassinate Trump…The DOJ charged 3 individuals in an assassination plot against Trump. Two are in custody and one is allegedly living in Tehran — the capital city of Iran.Some really interesting things are happening right now. pic.twitter.com/8rsDBdyjGk— johnny maga (@_johnnymaga) November 8, 2024 6 of these m-fers just deployed to Qatar plus boomers to the region…Maybe Trump will demand the surrender of the Iranian regime…or finally incinerate that whole goat f-ing rats nest…Volatility premiums increasing 2 months out…

Read More »Trump v Fed ?

9 days agoThis guy a MAGA Trump insider perhaps in line for AG (probably too much to hope he gets it 🙏🏻) but it’s revealing that he mentions the bankruptcy first…Trump’s opponents attempted to bankrupt him for non-fraud.And imprison him for life for non-crimes.And take him off the ballot.And take off his head. Now they want “unity”?Fuck them.Let’s unify them in prison.— 🇺🇸 Mike Davis 🇺🇸 (@mrddmia) November 8, 2024 Biden 2022 rate increases were unprecedented… so you can see what they did they put the rates way up to squeeze him, then they get commie kangaroos in NYC to impose half a billion dollars civil judgement in attempt to to bankrupt him… flushing the US CRE market down the toilet bowl in the process causing mini banking crisis in March 2023 … hoping Trump somehow got caught up in the

Read More »Functional finance — Lars P. Syll

9 days agoWhat monetarists. deficit hawks, and debt phobes don’t get. Quotes by Abba Lerner and John Maynard Keynes.Lars P. Syll’s BlogFunctional financeLars P. Syll | Professor, Malmo University

Read More »On Sraffa and Keynes — Lars P. Syll

10 days agoMinsky quote that underlies not only Keynes but also MMT.Lars P. Syll’s BlogOn Sraffa and KeynesLars P. Syll | Professor, Malmo University

Read More »Escobar: The Roadblocks Ahead For The Sovereign Harmonious Multi-Nodal World — Pepe Escobar

11 days agoWe will need weeks, months, years to fully grasp the enormity of what took place in Kazan during the annual BRICS summit under the Russian presidency.For the moment let’s cherish arguably the most appropriate definition of BRICS as a laboratory of the future: this lab, against nearly insurmountable odds, is actively engaged in creating a Sovereign Harmonious Multi-Nodal World.My take is that there were two tracks leading up to the meeting of BRICS+ in Kazan. The first track was widely reported in the Alt-Media and was wildly optimistic about the outcome since it focused almost exclusively on the "key players" none of whom had any political clout. It was even speculated that a new monetary system based on a BRICS+ currency would be announced. This turned out to be pie-in-the-sky.The second

Read More »Government job creation programs deliver significant (net) long-term benefits — Bill Mitchell

12 days agoOn April 5, 1933, US President Roosevelt made an executive decision to create the – Civilian Conservation Corps (CCC) – which was a component of the suite of government programs referred to as the – New Deal – that defined the Federal government’s solution to the mass unemployment that arose during the early years of the – Great Depression. These programs have been heavily criticised by the free market set as being unnecessary, wasteful and ineffective. Critics assert that no long-term benefits are forthcoming from such programs. However, those assertions are never backed by valid empirical evidence. A recent study by US academics has provided the first solid piece of evidence that the CCC delivered massive long-term benefits to the individuals who participated in it. And these benefits

Read More »MMT — debunking the deficit — Lars P. Syll

12 days agoLars comments on a quote from Stephanie Kelton’s The Deficit Myth showing the loanable funds theory being inconsistent with stock-flow accounting.Lars P. Syll’s BlogMMT — debunking the deficit Lars P. Syll | Professor, Malmo University

Read More »24 per cent annual interest on time deposits: St Petersburg Travel Notes, installment three — Gilbert Doctorow

13 days agoNot much happening regarding MMT these days.Herer is an anecdotal report on Russian banking. And, yes, you read that right. You get 24% not the bank.Doctorow is an American residing in Brussels who spends a good deal of time in Russia. His wife is Russian and he is fluent in Russian. A "Russianist," he has a a PhD in history (Harvard) and is a retired business person. His reporting does not conform to the narrative.Gilbert Doctorow—International relations, Russian affairs 24 per cent annual interest on time deposits: St Petersburg Travel Notes, installment threeGilbert Doctorow

Read More »Did The Latest BRICS Summit Achieve Anything Of Tangible Significance At All? — Andrew Korybko

14 days agoThe conclusion is that it’s a lot easier to talk about creating truly alternative institutions than actually doing so, which means that BRICS will likely just remain a talking club, or a “multitasking laboratory of global governance” as Kortunov diplomatically described it. That’s not to downplay the group’s role since it’s important for major and developing non-Western countries to discuss pressing issues of the evolving world order, especially economic-financial ones, but that’s not the same as what enthusiasts expected.A dose of reality. The Alt-Media got a quite a bit ahead of reality with respect to their expectations of the initial outcome.The Kazan Summit therefore wasn’t a failure, and in fact, it succeeded in its only realistic goal all along of gathering its members and partners

Read More »Rate policy

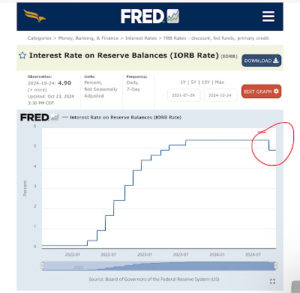

24 days agoDemocrat rate policy still has US overnight risk free IOR rate at 4.9% so what is so bad about a 10yr risk free UST rate of 4.2%? It’s still significantly inverted over time … usual Art degree moron suspects going apoplectic meanwhile a significantly inverted yield curve… hard to understand how these peoples brains work… 🤔

Read More »Pepe Escobar —Date With Destiny–BRICS Offers Hope in a Time of War

26 days agoPepe Escobar summarizes the state of play at the outset of the BRICS conference as it begans in Kazan, the capital of Tatarstan, Russian Federation. The heads of the central banks have already met in Moscow in preparation for discussing initial steps in an overhaul of the post WWII Bretton Woods monetary system and associated institutions established by and controlled by the West, the US in particular. Expectations had begun to exceed reality and now they are more modest but still positive.Sputnik InternationalPepe Escobar: Date With Destiny – BRICS Offers Hope in a Time of War

Read More »BRICS plans ‘multi-currency system’ to challenge US dollar dominance: Understanding Russia’s proposal — Ben Norton

27 days agoThe BRICS Cross-Border Payment Initiative (BCBPI) will use national currencies, instead of the US dollar. Russia’s finance ministry and central bank released a report detailing plans to transform the international monetary and financial system.Geopolitical EconomyBRICS plans ‘multi-currency system’ to challenge US dollar dominance: Understanding Russia’s proposalBen Norton

Read More »BRICS—facts and figures — Peter Hanseler/Denis Dobrin

27 days agoIntroductionIn the first part of this year’s BRICS series, we described the geopolitical environment in which BRICS is currently operating and trying to evolve. This environment has changed for the worse since the last BRICS summit in South Africa last August.The consequence is that BRICS cannot develop freely, because on the one hand, the decisions – especially those of the USA – regarding the wars in Ukraine and the Middle East, the situation in the financial markets and finally the elections in the USA will have serious consequences for the whole world. On the other hand, the decisions of the BRICS regarding the admission of new members and the introduction of a currency (unlikely) or a payment and settlement system (likely) will also have a major impact on the overall geopolitical

Read More »Improvement Of The International Monetary And Financial System — The Ministry Of Finance Of The Russian Federation, Bank of Russia, Yakov and Partners

October 18, 2024This is what will be presented at the upcoming BRICS + meeting. Download report at link below.Description on X here. (It’s nothing like the cheerleaders have been projecting.)BRICS Chairmanship ResearchImprovement Of The International Monetary And Financial SystemThe Ministry Of Finance Of The Russian Federation, Bank of Russia, Yakov and Partners

Read More »The Boy Who Cried Wolf About Government Debt —Yeva Nersisyan, L. Randall Wray

October 18, 2024In a New York Times editorial, David Leonhardt recounts Aesop’s apocryphal story about the boy and the wolf, warning that while deficit hawks have so far been wrong, the growing government debt will eventually bite. He reports the economic plans of both presidential candidates would add to the debt that will soon exceed GDP and grow to 130 percent of annual output under a President Harris, or 140 percent with a Trump presidency.The story of the boy and the wolf was a fable, although it was within the realm of possibility. The fable of the debt wolf is not. While there are real world wolves—Leonhardt mentions climate catastrophe and autocratic leaders, and the authors would add rising inequality and the concentration of economic and political power in the hands of billionaires.Levy

Read More »Episode 7 (S2) of the Smith Family Manga is now available–A revealing Zoom session — Bill Mitchell

October 18, 2024Today (October 18, 2024), MMTed releases Episode 7 in the Second Season of our Manga series – The Smith Family and their Adventures with Money. Have a bit of fun with it while learning Modern Monetary Theory (MMT) and circulate it to those who you think will benefit.…William Mitchell — Modern Monetary TheoryEpisode 7 (S2) of the Smith Family Manga is now available – A revealing Zoom sessionBill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Read More »How Australian Monetary System Favours the Powerful — Denis Hay

October 18, 2024MMT to the rescue (from neoliberalism). This applies similarly to other countries running under neoliberalism, which can be broadly characterized as policy formulation based on state capture by elites in a plutocracy masquerading as a democracy. Social Justice AustraliaHow Australian Monetary System Favours the PowerfulDenis Hay

Read More »LA Woman

October 12, 2024Great breakdown of a great song (by The Doors) by these 2 Millennial black bros… never understood the song as a metaphor for the city of Los Angeles but yeah I get it now… makes it even better…[embedded content]

Read More »The Deficit, the National Debt, and why we don’t have to worry about them. — John Rudden

October 10, 2024Short article on Stephanie Kelton’s The Deficit Myth.Daily KosThe Deficit, the National Debt, and why we don’t have to worry about them.John Rudden

Read More »Episode 6 of the Smith Family Manga (Season 2) is now available— Bill Mitchell

October 3, 2024Today (October 3, 2024), MMTed releases Episode 6 in the Second Season of our Manga series – The Smith Family and their Adventures with Money. Have a bit of fun with it while learning Modern Monetary Theory (MMT) and circulate it to those who you think will benefit. Episode 6 was delayed by two weeks…William Mitchell — Modern Monetary TheoryEpisode 6 of the Smith Family Manga (Season 2) is now availableBill Mitchell | Professor in Economics and Director of the Centre of Full Employment and Equity (CofFEE), at University of Newcastle, NSW, Australia

Read More »Modern Monetary Theory film proves finding the cash isn’t the problem — William Thomson

October 1, 2024As we have been writing for over a year in this newsletter, the UK Government, as the issuer of the UK pound, can never run out of money. They can afford whatever is priced in pounds. There is never a problem finding the money. This leads to a natural and painful conclusion: Continuing austerity policies is a political choice….The National (Scotland)Modern Monetary Theory film proves finding the cash isn’t the problemWilliam Thomson, Scotonomics founder

Read More »The ball is now in Finance Ministry’s court, Chinese economists say — Zichen Wang

September 30, 2024Apparently many influential Chinese economists are old-style Keynesians. There is no indication that they understand the basic principle of MMT — a sovereign currency issuer that doesn’t create financial obligation in currency it does not issue has a monopoly on its currency. This is especially important considering that China faces deflation rather than inflation.It’s up to the Finance Ministry now. Wikipedia:The Ministry of Finance of the People’s Republic of China (Chinese: 中华人民共和国财政部; pinyin: Zhōnghuá Rénmín Gònghéguó Cáizhèngbù) is the constituent department of the State Council of the People’s Republic of China which administers macroeconomic policies and the annual budget. It also handles fiscal policy, economic regulations and government expenditure for the state.The ministry

Read More »Class origins matter – but who are the agents of change? — Bill Mitchell

September 30, 2024Not MMT or economics as such but it is interesting in that Bill is an MMT founder so his stance on economic sociology is relevant. There was an interesting article in the UK Guardian the other day September 26, 2024) – Take it from me (and Keir Starmer) – you should never pretend to be more working class than you are. I don’t usually agree with the journalist but this article made me reflect on a lot of things.… Aside:The scrutiny arises because many of these “Labour people” appear to have accumulated wealth (real estate etc), have come from well-paid jobs and network with the elites in society.For that they are referred to, in a pejorative way, as ‘champagne socialists’.In the US, they (affected Democrats) are called "limousine liberals" and "latté liberals." A lot of the formerly

Read More »How I came to MMT — Robert Cauneau

September 21, 2024The discovery of a monetary approach, which, in this case, not only relates to a field that I was not familiar with, but also constitutes a total challenge to my own knowledge of public finance management, which I have practiced throughout my career, is not something trivial. So I decided to tell my own story.Interesting personal story.MMT FranceHow I came to MMTRobert CauneauThe article is available in French here.

Read More »China shit market

September 21, 2024Commies dilute their productive capital with unproductive commie bullshit = 0…Here is a wild chart. The total return on Chinese stocks since 1993 is negative. In contrast, India is a 13-bagger. pic.twitter.com/SPvczZxkld— Jeff Weniger (@JeffWeniger) September 20, 2024

Read More »The 20 EMU Member States are not currency issuers in the MMT sense — Bill Mitchell

September 16, 2024For some years now (since the pandemic), I have been receiving E-mails from those interested in the Eurozone telling me that the analysis I presented in my 2015 book – Eurozone Dystopia: Groupthink and Denial on a Grand Scale (published May 2015) – was redundant because the European Commission and the ECB had embraced and was committed to Modern Monetary Theory (MMT) so there was no longer a basis for a critique along the lines I presented. I keep seeing that claim repeated and apparently it is being championed by MMT economists. While there are some MMTers who seem to think the original architecture of the Economic and Monetary Union has been ‘changed’ in such a way that the original constraints on Member States no longer apply, I think they have missed the point. They point to the fact

Read More »