Only the top 20% saves.

Originally published at Wealth Economics

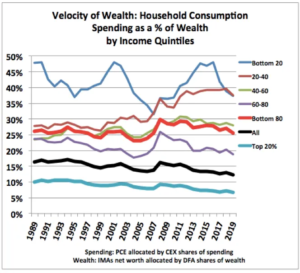

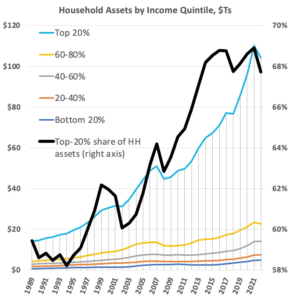

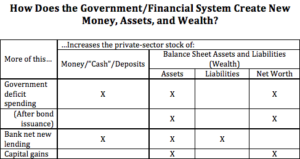

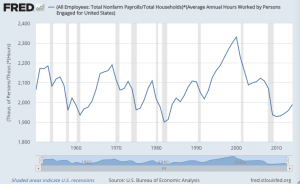

Newly released data series from the Bureau Economic Analysis have revealed a pretty eye-popping economic reality that’s been invisible in the national accounts…forever. Subtract households’ Personal Taxes and Personal Outlays from Personal Income to yield Personal Saving, and it turns out that the bulk of U.S. households don’t save. Quite the contrary: the bottom 80% spends more than its income, year in and year out. Only the top 20% consistently saves.1

This reality was invisible before publication of the Distribution of Personal Income Accounts (here, the “DPIAs”), first released in December 2020 and now in its fourth (greatly improved) prototype version, released December

Read More »