Yesterday I listened to this interview on the radio (Bloomberg's Surveillance) with Robert Shiller (you can jump to the last 9 minutes, that's when Shiller starts talking). He is for fiscal stimulus to get us out of the funk, but for higher rates to deal with outline asset prices. No discussion of using regulation to preclude speculation and bubbles in asset markets.PS: The piece cited at the beginning of the interview is this one.

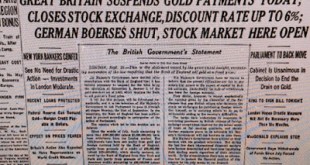

Read More »The end of the Gold Standard

NYTimes September 21, 1931 84 years ago Britain left the Gold Standard. Some thought it was the end of Western civilization. Keynes thought it was the beginning of the end of the Depression, at least in Great Britain. He was certainly happy. He said: "There are few Englishmen who do not rejoice at the breaking of our gold fetters. We feel that we have at last a free hand to do what is sensible. The romantic phase is over, and we can begin to discuss realistically what policy is for the...

Read More »On the Fed’s decision at the Rick Smith Show

[embedded content]

Read More »Fed keeps interest rate close to zero

The Fed has left the interest rate unchanged... for now. One dissident vote for raising the rate now. The main reason according to the press release is that: "Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term." Pressures for a hike in October or December will increase significantly, even if the official position is vague enough. They say: "The Committee anticipates that it...

Read More »Even The Economist is against raising the interest rate

In the last issue, The Economist suggests that the Fed should not be concerned too much with inflation, and that they should not raise the interest rate for now. They say: "Weak wage growth suggests that there is still lots of slack in the labour market. Underemployment, which includes workers who are part-time but want a full-time job, and discouraged workers who might be tempted back into the labour force, stands at just over 10%, higher than before the crisis. This measure probably has...

Read More »Interest rates, terms of trade and currency crises

Tomorrow, for those around Lewisburg, I'll present my paper on “Interest rates, terms of trade and currency crises” at the economics department's brown bag seminar series in ACWS room 116 from 11:45 to 12:50.

Read More »Minimum wage at historic low

Or close to. The figure below is not just the real minimum wage, which I posted before (most recently here). It is as it says the ratio of the minimum wage to the average wage. The figure neatly shows that while in the 50s and 60s the minimum wage was about 50% of the average wage, since the 1980s it has been closer to a third. Read rest here.

Read More »Debtors’ prisons are back

[embedded content] Although it's framed as a public defender issue, it is really about debtors' prisons and the criminalization of poverty.

Read More »Not sustainable: India’s trade and current account deficits

New paper by Suranjana Nabar-Bhaduri published by PERI. From the abstract:India’s trade balance and current account have shown persistent deficits for a major part of its post-independence period. Since the mid-2000s, trade deficits have increased perilously, with a sharp rise in both oil and non-oil imports. This has increased the magnitude of the current account deficit, as net earnings from services and remittances have been insufficient to offset the trade deficits. India has relied on...

Read More »From BBB-razil to BB+razil or the meaning of investment grade

So Brazil (or here about Petrobras, the State oil company) lost its investment grade status with Standard & Poor's. You would think this is huge given the media attention in Brazil. If you read S&P's actual rationale for the downgrading (here) it is essentially about the fiscal situation. They say: "We now expect the general government deficit to rise to an average of 8% of GDP in 2015 and 2016 before declining to 5.9% in 2017, versus 6.1% in 2014. We do not expect a primary fiscal...

Read More » Naked Keynesianism

Naked Keynesianism