I am temporarily departing from my usual finance & economics slant to write about something that I consider utterly shameful: the response of European countries, including my own, to the refugee crisis on their borders.This photo was taken on the Macedonian border today: : Herbert Mayrhofr tweeted this with a comment, "This is not the Europe that I want to live in".I wholeheartedly agree. What kind of society is it that will threaten toddlers with police batons?Many argue that Europe...

Read More »Making the case for public investment

Jeremy Corbyn’s “People’s QE” scheme has been extensively discussed in the media. In fact it has caused something of a storm. The FT’s Chris Giles did an excellent balanced analysis of it, and there have also been useful contributions from – among others - Oxford University’s Simon Wren-Lewis, The Economist’s Buttonwood and FT Alphaville’s Matt Klein. The extent of discussion is far more, in my view, than the scheme deserves. The scheme envisages that the Government, via a public...

Read More »The Co-Op Bank: too high a mountain?

The Co-Op Bank has revealed its 2015 half-year results. And they are not pleasant reading. It has made a statutory loss before taxation of £204m, considerably worse than the £77m loss reported in the 2014 half-year accounts. And the Board advises that the bank will not return to profit for another couple of years.The background to this horrible report is the Bank of England's stress tests last autumn. I didn't bother to look at the results at the time, since it was always obvious that the...

Read More »Never mind Greece, look at Venezuela

Via Business Insider comes this colourful map and chart of CDS spreads worldwide: Those who thought Greek bonds would be the most expensive to insure, since everyone knows it can't pay its debts, need to think again. Venezuela is the most expensive, by a long way. Related to that is this: The yield curve has been deeply inverted all year, but yields at all maturities are now rising: When even the yield on long-dated bonds is heading for 30%, the public finances are completely...

Read More »A Finnish cautionary tale

Eurozone growth figures came out today. And they are horribly disappointing. Everyone undershot, apart from Spain which turned in a remarkable 1% quarter's growth, and Greece which somehow managed an even more incredible 0.8% (yes, I will write about this, but not in this post). France didn't grow at all, Italy all but stagnated at 0.2%, and even the mighty Germany only managed 0.4%. Despite low oil prices, falling commodity prices, weak Euro and the ECB's QE programme, Eurozone...

Read More »In defence of the (conflicted) ECB

Everyone has been so transfixed by Yanis Varoufakis's "Plan B" revelations that his defence of the ECB's Mario Draghi passed unnoticed. Here it is, transcribed from the Lamont tape by Peter Spiegel at the FT:Mario Draghi has handled himself as well as he could, and he tried to stay out of this mire, the political mire, impressively. I have always held him in high regard. I hold him in even higher regard now, having experienced him over the last six months. Having said that, the European...

Read More »Lies, damned lies, and Greek statistics

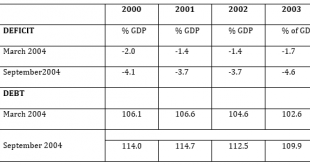

Guest post by Sigrún DavídsdóttirThe word “trust” has been mentioned time and again in reports on the tortuous negotiations on Greece. One reason is the persistent deceit in reporting on debt and deficit statistics, including lying about an off market swap with Goldman Sachs: not a one-off deceit but a political interference through concerted action among several public institutions for more then ten years.As late as in the July 12 Euro Summit statement "safeguarding of the full legal...

Read More »When reason departs

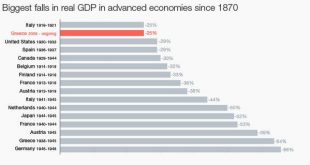

In my last post, I pointed out that Greece's current depression is by no means the worst since World War II, as is often stated, and that the US's Great Depression was not the worst depression in history either. For reference, I'm putting up Tony Tassell's chart again.I'm frankly appalled by the comments on that post. The arguments used to justify the prevailing views amount to the following.1. The other countries in the list aren't rich Western countries, so they don't count.Eh???2....

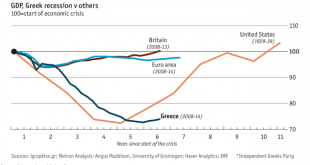

Read More »Not such a Great Depression

We're used to hearing that the current Greek depression is the longest and deepest since World War II, aren't we? And that the worst depression in history was the US's Great Depression?Via the FT's Tony Tassell comes this chart:Looks like the fall of the Iron Curtain, the collapse of the Soviet Union and the first Gulf War did far more damage. Not to mention the numerous wars and crises in Africa. The current Greek depression just about makes it on to the bottom of this chart, and the other...

Read More »The Great Greek Bank Drama, Act II: The Heist

The banks are re-opening, though just for transactions, so people can pay their bills and their taxes, pay in cheques, that kind of thing. The cash withdrawal limit has been changed to a weekly limit of 420 EUR per card per person, enabling households to manage their cash flow better. But the capital controls remain: money cannot leave the country without the agreement of the Finance Ministry. And the banks remain short of cash: although the ECB has raised the funding limit by 900m EUR, that...

Read More » Francis Coppola

Francis Coppola