Looks like this source of private sector deficit spending may have been the driver behind about 1.5% of GDP growth, taking the place of bank lending. But most recently the growth looks to have slowed: US Q1 earnings tipped for first decline in 3 years (FT) Consensus estimates point to a 0.8 per cent drop in earnings per share this quarter, according to FactSet, a dramatic markdown from a forecast of 3.3 per cent growth at the end of December. With about half of the...

Read More »US factory orders, Euro zone retail sales, UK services, ISM NY, Lumber prices

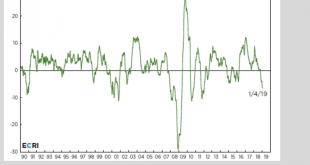

Global retreat underway? US ISM New York Index at 7-Month Low in January

Read More »Euro zone, China, Amazon, US employment

Lots of headlines pointing to corporate weakness: Amazon sales outlook falls short after record holiday quarter (Reuters) Fast and free shipping helped the world’s largest online retailer boost revenue by 20 percent. Net income jumped 63 percent to $3 billion for the fourth quarter. Its international operating loss shrunk to $642 million in the quarter from $919 million a year earlier. The company forecast net sales of between $56 billion and $60 billion for the first...

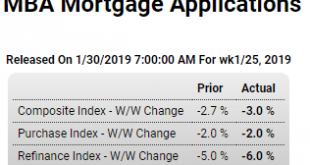

Read More »News headlines- weakness continues, Mtg apps, Pending home sales, Confidence, ADP employment, MMT articles

Apple says China sales fell 27% last quarter (Nikkei) Apple’s net sales in greater China, including the mainland, Hong Kong and Taiwan, fell 27% on the year to $13.17 billion for the three months ended Dec. 29 in results announced Tuesday. This marked the first downturn there in six quarters. Combined sales elsewhere, including the U.S., Europe and Japan, grew 1% to $71.1 billion, pointing to China as the central cause of the sluggish quarterly results. Greater China as a...

Read More »Trade, China

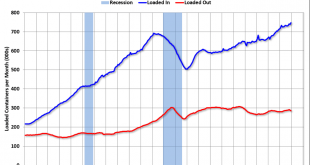

Imports up, exports down: China’s December industrial profits fall for 2nd straight month (Reuters) Profits notched up by China’s industrial firms declined 1.9 percent from a year earlier to 680.8 billion yuan ($100.9 billion) in December. For the full-year of 2018, industrial profits increased 10.3 percent on an annual basis to 6.64 trillion yuan, versus the 11.8 percent gain in the January-November period, the National Bureau of Statistics (NBS) said on its website....

Read More »Global growth indicators

Agent Orange, AKA Tariff Man, taking down the global economy: Intel Projects Slower Revenue Growth This Year (WSJ) Intel Corp. reported a 9% gain in revenue. Customers’ robust appetite for server chips boosted data-center businesses by 45% through the first nine months of 2018, but now those buyers need to digest those purchases, finance chief and interim chief executive Bob Swan said. That slowdown will hit the next two quarters as well, he said. The company now...

Read More »Sentiment indicators, Shutdown slowdowns

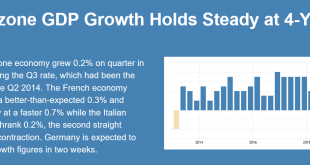

Euro area business growth close to stalling at 5½ year low in January (Markit) Flash Eurozone PMI Composite Output Index at 50.7 (51.1 in December). Services PMI Activity Index at 50.8 (51.2 in December). Manufacturing PMI Output Index at 50.4 (51.0 in December). Manufacturing PMI at 50.5 (51.4 in December). The factory sector reported the weakest expansion since the current production upturn began in July 2013, while the service sector expansion was the smallest since...

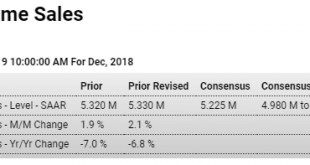

Read More »Existing home sales, Trade, BOJ

Bad: Highlights Mortgage rates began to move down in December but it wasn’t soon enough to help the month’s resales. Existing home sales fell a sharper-than-expected 6.4 percent to a 4.990 million annualized rate that is the lowest in more than three years and barely makes Econoday’s consensus range. Weakness across the board is a fair description of the results with single-family sales down 5.5 percent to a 4.450 million rate and condo sales down 12.9 percent to 540,000....

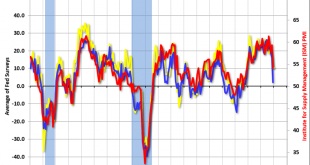

Read More »Surveys, Housing 55+ and investment, FT mention

Trade issues taking their toll: This too has gone flat: Nice mentions for Stephanie and a also bit for me here, as MMT is now on a roll: https://ftalphaville.ft.com/2019/01/16/1547640616000/America-has-never-worried-about-financing-its-priorities/

Read More »Budget, Asian airfreight, US profit forecast, Growth index, Capex, Share buybacks

December 2018 CBO Monthly Budget Review: Total Receipts Up by 1% And Spending Up 9% in the First Quarter of Fiscal Year 2019 The federal budget deficit was $317 billion for the first quarter of fiscal year 2019, CBO estimates, $92 billion more than the deficit recorded during the same period last year. Revenues were about the same and outlays were $93 billion (9 percent) higher than during the first quarter of 2018. Asian airfreight traffic drops for first time in 2.5...

Read More » Mosler Economics

Mosler Economics