As suspected, the drop in gas prices was pretty much a net 0 for GDP: Consumers are spending a lot more of their gasoline savings than estimated, report says Americans spend majority of money saved at the petrol pump JPMorgan: Consumers Already Spent Most Savings From Cheap Gas Pump Prices > The post Gas savings spent appeared first on The Center of the Universe.

Read More »German Trade, Japan

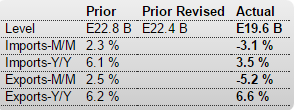

Exports down but so are imports, indicating a weak global economy and continued euro support from trade net flows: Germany : Merchandise Trade German exports plunge at fastest pace since global financial crisis Oct 8 (Reuters) — German exports plunged in August. Data from the Federal Statistics Office showed seasonally-adjusted exports sliding by 5.2 percent to 97.7 billion euros month-on-month, the steepest drop since January 2009. Imports tumbled by 3.1 percent to 78.2 billion...

Read More »Consumer Credit

Now looking like this peaked as oil prices collapsed: Consumer Credit Highlights Revolving credit continues to show life, up a solid $4.0 billion in August for a sixth straight gain. Gains in this reading, which have been scarce this recovery, perhaps suggest that consumers are growing less reluctant to run up their credit cards, which would be good news for retailers going into the holidays. Non-revolving credit, driven by both vehicle financing and student financing which is tracked in...

Read More »Capex Cuts, Mtg Purchase Apps

Volkswagen to Pare, Delay Capital Investments Oct 6 (WSJ) — Volkswagen AG plans to slash an €86 billion ($96 billion) investment plan and step up cost-cutting as it grapples with fallout from its emissions scandal, Chief Executive Matthias Müllersaid on Tuesday. Global Oil to Cut Spending by $130 Billion, OPEC Says Germany : Industrial Production Highlights Industrial production was weaker than expected in August. A 1.2 percent monthly fall exactly reversed an upwardly revised gain...

Read More »Exports, News Headlines, Atlanta Fed, German Comment

They say its the strong $ that’s hurting exports. I say it’s the drop in oil related capex after the price collapse: This is what news headlines have been looking like (not good): From Rüdiger (top German Specialist) research: German new business orders for August were broadly lower. Compared to July, which was revised downward, they fell a seasonally adjusted 2.1pc. Compared to August 2014 orders rose 3.4pc. However, there are two critical factors behind this figure....

Read More »Saudi Oil Production, US Trade, Gallup Index, Redbook Retail Sales, German Manufacturers’ Orders

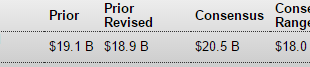

Their price cuts reported yesterday indicate they’d like to pump more: Gap widening as previously suspected, even with lower oil prices: International Trade Highlights A surge in imports of new iPhones helped feed what was an unusually wide trade gap in August of $48.3 billion, well up from July’s revised $41.8 billion. But cell phones, at $2.1 billion, make up only a portion of the gap with a drop in exports the most salient factor. Exports were down nearly across the board...

Read More »Capex Revision, Gallup Spending Survey, PMI, ISM Non Mfg Index

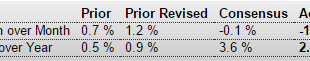

A gauge of U.S. investment plans slipped more in August than initially estimated, giving a cautionary sign for the economic outlook. New orders for non-military capital goods outside of aviation fell 0.8 percent in August, the Commerce Department said on Friday. The government had previously reported that this gauge, which is a leading indicator of business investment, had fallen 0.2 percent during the month. Shipments of this category of goods also fell, declining a...

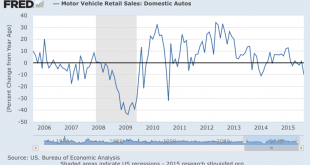

Read More »Saudi Price Cut, Domestic Car Sales, Commercial Paper

This is how they would start a downward price spiral if that’s what they wanted: Saudi Aramco Cuts Crude to Asia, U.S. Amid Weak Demand By Anthony Dipaola Oct 4 (Bloomberg) —Saudi Arabia cut pricing for November oil sales to Asia and the U.S. as the world’s largest crude exporter seeks to keep its barrels competitive with rival suppliers amid sluggish demand. Saudi Arabian Oil Co. reduced its official selling price for Medium grade crude to Asia next month to a discount of $3.20...

Read More »NY ISM index

Even the city is turning south: The post NY ISM index appeared first on The Center of the Universe.

Read More » Mosler Economics

Mosler Economics