Continuing on from Workshop 4, this workshop: Explains how to build a monetary model of capitalism in Minsky, using its Godley Tables; Explains the role of credit in aggregate demand and aggregate income; Shows how the data overwhelmingly confirms the Post Keynesian "Endogenous Money"/"Bank Originated Money and Debt" approach to macroeconomics and contradicts the Neoclassical "Loanable Funds", moneyless-macroeconomics; Explains that Minsky's Financial Instability Hypothesis was inspired by...

Read More »Workhop 06 Post Keynesian Dynamics using Minsky

Following on from Workshop 5, this workshop: Includes a presentation of a Minsky model of the shadow banking sector by Nick Jackson, who built the model while doing his Masters degree with me at Kingston University London, and who is now working on shadow banking at the Bank of England; Introduces Pedro Pratas's Minsky model of the Portuguese economy, which he developed initially while doing a Masters degree in Portugal, and is now developing further for his PhD; Shows how Neoclassicals have...

Read More »Workshop 04 Post Keynesian Dynamics using Minsky

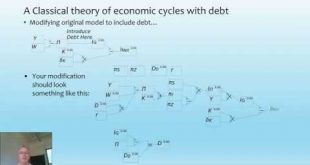

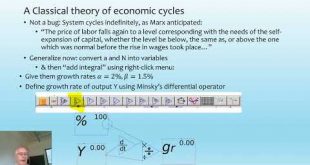

Building a model of Minsky's Financial Instability Hypothesis on the foundations of Goodwin's model; The emergent properties of this model: (1) A cyclically rising debt level (predicted by Minsky) (2) Rising inequality (probably expected by Minsky, but not predicted) and (3) Diminishing cycles in employment, economic growth, and inflation, before a crisis (totally unexpected); The pathetic reaction of Neoclassical economists to the Bank of England's paper rejecting Loanable Funds and...

Read More »Workshop 03 Post Keynesian Dynamics using Minsky

Building the basic Goodwin model in Minsky; Deriving the same model from macroeconomic definitions; Analysing its (in-)stability using its Jacobian matrix; Empirical test of the Goodwin model by Grasselli and Maheshwari; The red-herring of the current Neoclassical debate on the Phillips Curve; What Phillips actually said and was doing in the 1950s--building engineering-style nonequilibrium models of the economy;

Read More »Workshop 02 Post Keynesian Dynamics using Minsky

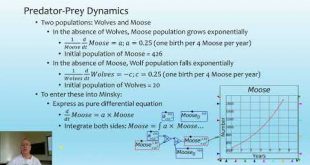

Following on from the first workshop, this video covers (1) The design of a basic predator-prey model in Minsky; (2) The first computer-simulated model of complex systems, Lorenz's model of turbulent fluid dynamics that gave the world "the butterfly effect""; (3) The basic logic of Goodwin's Growth Cycle model, which was based on Marx's verbal model of economic cycles in Capital I Chapter 25.

Read More »Workshop 01 Post Keynesian Dynamics using Minsky

This is the first in a set of six lectures/workshops I gave to students at the "Summer Academy for Pluralist Economics 2019: Economics in Transformation" held in Thuringia, Germany on August 9-16, 2019. It follows a set of five lectures on the history of Post Keynesian economics by Elisabeth Springler of the Technical College of the BFI in Vienna. This introduction covers the (non-)history of dynamic analysis in economics, and the basics of designing a model in Minsky, the Open Source...

Read More »Talk to Masters students at Chulakongkorn University, Bangkok

My good friend (and Patron!) Paul Gambles took advantage of my holiday in Thailand (en route to Sydney for a sister's 60th birthday party) to arrange a talk at Chulalongkorn University. I cover my usual monetary topics--why economics textbooks are wrong about money creation, and why this is extremely important for macroeconomics--and the reactionary emphasis by economists on equilibrium modeling when the rest of the world has now grown up sufficiently to model the real world as the far...

Read More »Scottish Economics Conference Glasgow: Economics of Debt (& Climate Change)

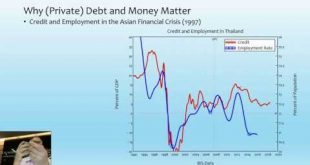

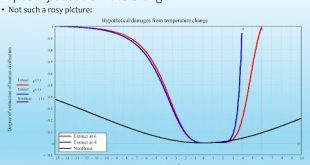

This keynote to the student-organized Scottish Economics Conference held in Glasgow in February 2019 covers the macroeconomics of private debt and credit, and in the final minutes, covers the absurdity of the "damage function" that Nordhaus uses to conclude that a 6 degree temperature rise--a level which last occurred during what's known as the "Permian Extinction" when about 80% of all then existing life forms went extincy--will cause a mere 8.5% fall in GDP.

Read More »Manchester 2019 The Magnificent Failure of Neoclassical Economics

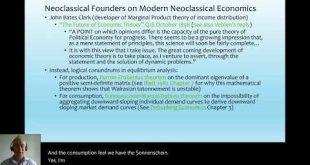

Virtually every time Neoclassical Economists explored the stability of an equilibrium in one of their models, they found it was unstable. How did they react to this discovery? By either ignoring it, or by using elaborate workarounds to avoid it. In the process, their analysis has gone from Walras' original vision of a simple price adjustment process which could lead to all markets being in equilibrium at once, with agents knowing only their own tastes, their existing stocks of different...

Read More »Talk at the ECB on Energy and Credit

This talk at the European Central Bank covers the failure of economic theorists of all persuasions, not only Neoclassical, to properly incorporate energy into their models of production, and the failure of Neoclassical economists to properly incorporate money and credit. In both cases, I show that there is an easy way to overcome this deficiency: to treat Energy as an input into Labour and Capital, without which neither can function; and to model capitalism as a monetary system in which bank...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch