Lectures from the Kingston Masters program module Economic Change and Ideas. These three hours of lectures cover the macroeconomics of endogenous money. They compare Endogenous Money to Loanable Funds using the Open Source system dynamics program Minsky, and explain how change in debt affects both aggregate expenditure and aggregate income

Read More »3 Steve Keen Kingston Masters lectures on endogenous money (1)

Lectures from the Kingston Masters program module Economic Change and Ideas. These three hours of lectures cover the macroeconomics of endogenous money. They compare Endogenous Money to Loanable Funds using the Open Source system dynamics program Minsky, and explain how change in debt affects both aggregate expenditure and aggregate income

Read More »Rethinking Economics at the London School of Economics

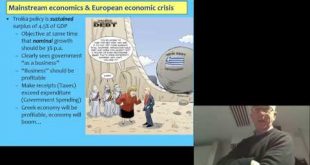

I was invited by the Rethinking Economics student association at the London School of Economics to give a talk about Greece, Austerity, Post Keynesian Economics and anticipating the crisis. There was an excellent audience of around 150 for the talk, and a good discussion (which unfortunately was not recorded).

Read More »Hamburg 2014: Post Keynesian economics, falling marginal cost, and money

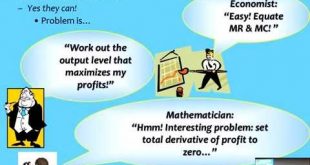

At the request of the Rethinking Economics students at Hamburg (who commented that 98% of the students there would never have heard of Post-Keynesian economics, given how narrow the curriculum was) I gave a quick overview of Post Keynesian economics, followed by an example of one Post Keynesian critique of Neoclassical economics--the empirical invalidity of the assumption of rising marginal cost--and then covered Endogenous Money versus Loanable Funds and Minsky's Financial Instability...

Read More »Free University Berlin: Demand, Competition and Money

The organisers asked me to cover some of the critiques in Debunking Economics (http://www.amazon.com/Debunking-Economics-Expanded-Integrated-Dethroned-ebook/dp/B00A76X054), so I explained the failure of Neoclassical Economics to derive a market demand curve from individual ones (the "Sonnenschein-Mantel-Debreu Theorem") and the invalidity of the model of perfect competition (http://www.paecon.net/PAEReview/issue53/KeenStandish53.pdf)

Read More »Beijing Lecture 4: The role of private debt in Macroeconomics Part A

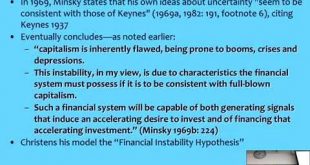

Mainstream Neoclassical macroeconomics ignores banks, debt and money; Post Keynesian economics considers them but hasn't yet incorporated the role of private debt into its macroeconomics. This lecture makes the logical case for the role of private debt in macroeconomics, and models Minsky's Financial Instability Hypothesis. Warning: sound in part B of this lecture sucks! No idea why--it was recorded contiguously with Part A. Maybe someone knocked the dial on the microphone. So my apologies...

Read More »Beijing Lecture 3: Minsky’s alternative non-equilibrium paradigm Part C

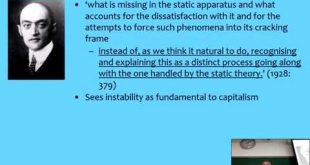

Minsky's Financial Instability Hypothesis builds upon and integrates a non-equilibrium approach to macroeconomics which can be traced back not merely to Keynes but also Goodwin, Fisher, Schumpeter, and Marx.

Read More »Beijing Lecture 3: Minsky’s alternative non-equilibrium paradigm Part B

Minsky's Financial Instability Hypothesis builds upon and integrates a non-equilibrium approach to macroeconomics which can be traced back not merely to Keynes but also Goodwin, Fisher, Schumpeter, and Marx.

Read More »Beijing Lecture 3: Minsky’s alternative non-equilibrium paradigm Part A

Minsky's Financial Instability Hypothesis builds upon and integrates a non-equilibrium approach to macroeconomics which can be traced back not merely to Keynes but also Goodwin, Fisher, Schumpeter, and Marx.

Read More »Beijing Lecture 1: Failure of Neoclassical Paradigm Part C

Neoclassical economics was triumphant before the economic crisis and has been in both disarray and denial since. This lecture covers why the evolution of Real Business Cycle and DSGE modeling from the original IS-LM approach was necessary for Neoclassical thought in order to be consistent with its core belief that monetary factors do not determine the level of real economic activity

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch