Minsky has been chosen as SourceForge's Project of the Month for January 2014. This is the 8th in a set of 8 brief videos to give an overview of the program for new users and potential developers. This video shows a simulation of a Minsky banking model, and notes that the accountant's DR and CR notation can be used rather than Minsky's default + and - symbols.

Read More »Basic Minsky 05 Simulation

Minsky has been chosen as SourceForge's Project of the Month for January 2014. This is the 5th in a set of 8 brief videos to give an overview of the program for new users and potential developers. This shows off some graphing and simulation control features.

Read More »Basic Minsky 04 Simulation

Minsky has been chosen as SourceForge's Project of the Month for January 2014. This is the 4th in a set of 8 brief videos to give an overview of the program for new users and potential developers. It converts a couple of independent population growth (and decay) variables into a predator-prey system.

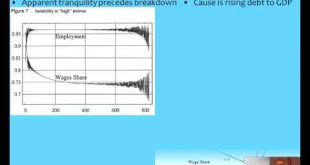

Read More »Amsterdam lecture: private debt, the crisis, economics & the future

My lecture at the Duisenberg School of Finance focused on the peculiar failure of economic theory to appreciate the role of private debt in causing the economic crisis, and the possible future we face now that private debt is rising once more after only a minor level of deleveraging from the highest level of aggregate private debt in human history.

Read More »What might happen when Quantitative Easing is Eased

A speech to a meeting of clients of Dun and Bradstreet at the Globes 2013 conference on what QE is, and whether tapering might have negative effects on the economy. I use the Minsky Open Source modelling program to sketch out the possible effects. I conclude that the damage is likely to be felt on Wall Street rather than Main Street, where QE has always been mainly a placebo, rather than a cure for what truly ails the economy

Read More »Keen 2013 Manchester: Could and should economics have anticipated the crisis?

My contribution to a debate on this topic organized by the Post Crash Economics Society at Manchester University--a group of students who are campaigning for reform of the economics curriculum as I did at Sydney University way back in 1973.

Read More »The International Financial Architecture

My speech to the Meeting of Finance Ministers of Latin America in Quito on November 29th 2013. I explain Keynes's proposal for an international unit of account called the Bancor, and support Zhou Xiaochuan, the Governor of the Central Bank of China, in calling for its introduction. I also argue that Latin America should in the meantime develop its own unit of account for intra-CELAC trade.

Read More »Comparing Minsky to Simulink

Minsky is primarily designed to enable the financial sector to be easily modeled in a dynamic economic model. We have also tried to improve on the interfaces used in existing programs. This video compares Minsky to the industry leader in engineering, Matlab's Simulink. Of course Minsky is far less powerful, since it has had far less development time put into it; but we believe that it is much easier to use than Simulink, and far superior for modeling financial flows thanks to the innovation...

Read More »Olso talk on the failings of academic economics

Over my 40 year career in economics, economics has declined from a mandatory 40% of most business degrees to just 4%, with that rump due solely to the compulsory economics unit required for certification as an accountant. Let's reform economics by continuing its self-destruction as a University subject. Accountants, why not develop your own "Economics for Accounting" unit?

Read More »Talk to Statistics Norway about economics, debt and endogenous money

This is an invited talk at Statistics Norway about endogenous money, the crisis, and the sort of data that statisticians should collect in the light of endogenous money theory..

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch