Norway has done a lot of things right, including discovering North Sea oil of course, but unlike the UK, using that to build a sovereign wealth fund, excellent infrastructure, and a diversified industrial base. But it has also accumulated the third highest level of private debt in the world (relative to GDP), and in the last twenty years, real house prices have increased fourfold. It is one of my prime candidates for a financial crisis, which may already be commencing with decelerating...

Read More »Meet cartoonist Miguel Guerra (& Suzy Dias) illustrator of FERIR/Reality Virus/Money cartoons

I'm working with Miguel Guerra and Suzy Dias to produce two illustrated works: one a book of satires of economists "EconComics"; and the other the Money Cartoon, financed by a Kickstarter campaign. In this video we discuss Miguel's illustrations from my paper "WHO* warns of outbreak of virulent new ‘Economic Reality’ virus" (https://www.elgaronline.com/view/journals/roke/5-1/roke.2017.01.08.xml). Miguel and Suzy's visual jokes beautifully complement my satire. The Kickstarter project has...

Read More »How can the Greeks save more money? A monetary parable.

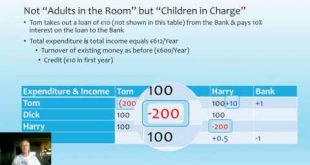

The EU's "Stability and Growth Pact" has as one of its primary rules that “The Member States undertake to abide by the medium-term budgetary objective of positions close to balance or in surplus…” I explore what this objective implies in the context of a model of the economy of "TomDickHaria": what happens to its collective GDP where one member tries to achieve the surplus goal set out in the "Stability and Growth Pact?

Read More »Talk at Rethinking Economics Bologna on post-Neoclassical Economics Teaching & Research

I'm preparing for a post-University role as a campaigner for the reform of economics teaching and research (see https://www.patreon.com/ProfSteveKeen), so the invite to speak on the topic of "The future of Economics teaching and research" at a Rethinking Economics conference in Bologna last week was extremely well timed. Unfortunately the recording at the venue itself stuffed up (no sound), and there wasn't time to give the entire talk since, unexpectedly, the great Luigi Pasinetti agreed to...

Read More »A Biographical Economic Interview with Peter Kelly of East London Radio

This is an extensive and intense interview with Peter Kelly of East London Radio. We covered all manner of topics in just on an hour. I won't try to detail all the topics here because there were just too many! I hope you find it an interesting conversation. The sound volume may be a but low; if so, just turn it up. The video is just that shot of my Patreon campaign (https://www.patreon.com/ProfSteveKeen), which as of today has 308 Patrons providing me with US$2665 net per month. This is...

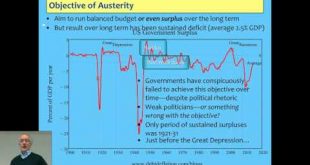

Read More »Kingston Contemporary Issues Lecture 08 Austerity

Mark Blyth describes Austerity as a "dangerous idea", and I give a monetary explanation of why Mark is right. The whole vision of "sound finance" is a recipe for the collapse of capitalism. Rather than "saving for a rainy day", austerity causes economic cyclones. The only two sustained periods of government surpluses in the USA's history preceded its two greatest economic crises, the Great Depression and the Great Recession. These were not coincidences.

Read More »Kingston Contemporary Issues Lecture 7 the Euro Crisis

In 1992, Wynne Godley predicted that the Euro would amplify any future economic downturn into a crisis: "“ If a country or region has no power to devalue, and if it is not the beneficiary of a system of fiscal equalisation, then there is nothing to stop it suffering a process of cumulative and terminal decline leading, in the end, to emigration as the only alternative to poverty or starvation…"

Read More »Kingston Contemporary Issues Lecture 6 Minsky and explaining the Global Financial Crisis

This lecture covers how Hyman Minsky developed his "Financial Instability Hypothesis" to answer the question “Can "It"—a Great Depression—happen again?", by combining insights from Marx, Fisher, Schumpeter, Kalecki, and finally Keynes. I show how his model can be explained simply by working from the macroeconomic definitions of employment, income distribution, and debt. It is, at its heart, the simplest possible complex systems explanation of how a market economy with debt can fall into a...

Read More »The Myth of the Money Multiplier

This is one of the most widely believed models in economics, but it is simply wrong, I show how this false model drove the policy measures by Central Banks during the economic crisis, resulting in huge expenditures being needed to cause relatively trivial stimuli.

Read More »Banks as intermediaries versus banks as loan originators

This short video illustrates why banks, debt and credit matter in macroeconomics, by starting from the Neoclassical vision of the world in which it's OK to ignore those issues. I model the Neoclassical "Loanable Funds" model in my system dynamics program Minsky, and it's easy to see why they ignore banks, debt and money in their macroeconomics. If they were right about banks merely being intermediaries, then private debt wouldn't matter to the macroeconomy. However, it takes about 30...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch