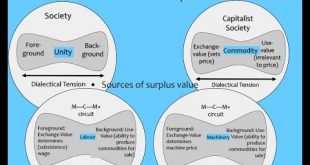

Most of my lectures annoy Neoclassicals; this one is going to annoy Marxists. Using the energy-aware production function derived in the previous lecture, I argue that the "Labour Theory of Value" asserts that production is entirely a function of the energy input to unskilled labour--which is absurd. I then explain the dialectical interpretation of Marx, which thankfully contradicts the "Labour Theory of Value" and is also compatible with an energy-based model production. It also provides a...

Read More »Keen 2016/7 Financialisation01 Value And Thermodynamics

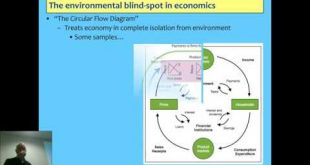

What is "value"? I take the question back to the basics of how is it that we can produce a net output? The answer has to be consistent with the Laws of Thermodynamics, and on that basis, every school of thought from the Neoclassicals to the Marxists, is wrong. I introduce a new production function in which energy plays an essential role. I've previously posted a video on this topic, but this is my first presentation of the concepts to a group of students.

Read More »Teaching Economics the Pluralist Way: no more airbrushed economics from any school

This is a speech I gave to the Amsterdam Rethinking Economics students when they launched their survey on the state of economics teaching in The Netherlands, laving out key principles for teaching economics the pluralist way: 1 Teach Honestly: Give a “Warts and All” treatment of every school 2 Read the original sources—journals & books—not textbooks 3 Let experts teach maths & computing, not economists 4 Facts exist & are not theory-neutral 4.1 Rules of accounting versus Money Multiplier...

Read More »The Role of Energy in Production. Explaining “Solow Residual” as energy’s contribution to output

Economic theory has failed to incorporate the role of energy in production for two centuries since the Physiocrats. In this video I derive a production function that includes energy in an essential manner. It implies that economic growth has been driven by the increase in the energy throughput capabilities of machinery. NOTE: As a viewer pointed out, I should set alpha to 0.3 rather than 0.7 here. I swapped usual treatment of which input was raised to alpha but forgot to swap the values as...

Read More »Real Vision interview excerpts. Finance sector as a good servant but lousy master of capitalism

I was interviewed by the Raoul Pal Real Vision online investor TV program recently. This five minute excerpts covers some of the main points, including the cause of the 2008 crisis, and why mainstream economists missed it; why the economy is moribund today; how a "modern debt jubilee" could reduce private debt and enable a recovery in credit-based demand to occur; and the need to reform the finance sector so that it is profitable for it to finance entrepreneurs rather than asset bubbles....

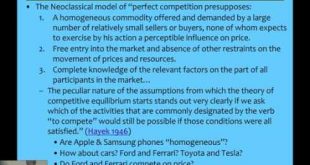

Read More »Kingston 2016 Becoming an Economist Lecture 3: The Austrians (2/2)

The Austrian School shares the same theory of value foundations as the Mainstream, but rejects its use of both equilibrium thinking and equilibrium-oriented mathematical modelling. I cover Hayek, complexity, and the Austrians most Austrians reject, Joseph Schumpeter.

Read More »Kingston 2016 Becoming an Economist Lecture 3: The Austrians (1/2)

The Austrian School shares the same theory of value foundations as the Mainstream, but rejects its use of both equilibrium thinking and equilibrium-oriented mathematical modelling. I cover Hayek, complexity, and the Austrians most Austrians reject, Joseph Schumpeter.

Read More »Kingston 2016 Becoming an Economist Lecture 2: The Mainstream

The first 4 minutes and 42:40 till 52:30 are devoted to administrative and representative issues at Kingston. The rest of the lecture covers the evolution of the "Neoclassical" Mainstream from Walras's puzzle of "Can a set of free markets reach equilibrium in each and every market at once?" to the current criticism of the mainstream by leading Mainstream economists today. NOTE: I didn't record the first lecture of this year's course due to misplacing a necessary cable. If you'd like to see...

Read More »Alternative economics 3: Debt & Credit in Capitalist Economies & using Minsky

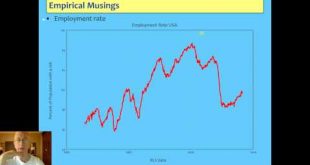

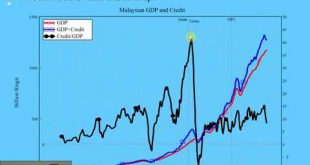

(1) The "Smoking Gun of Credit", including graphs for Malaysia and Singapore [Minutes 0-6] (2) Why Credit is a fundamental component of aggregate demand and income [5-19] (3) Designing a monetary model in free Open Source system dynamics program Minsky [19-52] (download from https://sourceforge.net/projects/minsky/) (4) Building a cyclical model in Minsky [52-End]

Read More »Alternative economics 2: Empirical & Logical Fallacies in Neoclassical economics

Neoclassical microeconomics is based, not on "simplifying" assumptions that omit insignificant details of reality to focus on the significant issues, but on "counter-factual" assumptions which flatly contradict what we know about significant economic issues. I cover: (1) Friedman's methodological assertion that "assumptions don't matter" was actually done to advise economists NOT to read empirical literature contradicting the idea of rising marginal cost [Minutes 1-5]; (2) The logical...

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch