In this half of the lecture, I show that even if there was a downward-sloping demand curve, Neoclassical supply and demand analysis is still invalid because: (a) Equating marginal cost and marginal revenue doesn't maximize profits; and (b) A market supply curve can't be derived independently of the demand curve.

Read More »Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 2

In this second half of the first lecture, I explain Sippel's result that most people aren't "rational" as Neoclassical economists define it--because the Neoclassical definition of rational behavior is computationally impossible. The next lecture--which I'll post next week--explains that even if the Neoclassical model of individual behavior was sound (which I've just shown it isn't), the market demand curve derived by aggregating the demand functions of "rational utility maximizing...

Read More »Keen Behavioural Finance 2011 Lecture01 Economic Behaviour Part 1

This is the first of about 20 videos of my lectures in Behavioural Finance at the University of Western Sydney (2 videos per lecture). This first lecture presents the Neoclassical theory of consumer behavior--known as Revealed Preference--and an experiment that invalidated it by the German economist Reinhard Sippel.

Read More »Finance Education “After” the Crisis

Finance theory, since it takes neoclassical economics as its starting point, is even more flawed than neoclassical economics itself. Here I point out how absurd its abuse of the English language has been--using "Efficient" and "Rational" to describe behavior that any sensible person would see as "prophetic"--and discuss how it should be reformed.

Read More »Al Jazeera Interview on Credit Rating Agencies

The Credit Rating agencies have helped cause this crisis by (a) being for profit organizations whose ratings are paid for by the sellers of financial instruments and (b) giving advice that might be useful in episodic events but which makes systemic crises worse.

Read More »Why Neoclassical Economists Didnt See the Great Recession Coming

Mainstream "Neoclassical" Economists famously did not see the Great Recession coming, and when you look at their theories, it's no wonder. Their favourite model prior to the crisis goes by the name of "Dynamic Stochastic General Equilibrium", or DSGE. These models imagined that the entire economy could be modeled as a single individual. Yet neoclassical researchers proved decades ago that even a single market can't be modeled that way. I explain this proof while outlining the fundamental...

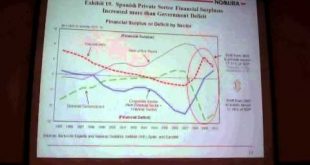

Read More »Richard Koo AT THE 2011 Argentine Central Bank Conference

Richard Koo outlines his argument that the government should run a deficit to sustain aggregate demand during a period like now when the private sector is deleveraging.

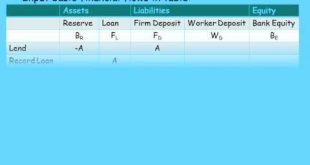

Read More »The failure of Neoclassical Macro and the Monetary Circuit Theory Alternative

In writing Debunking Economics II, I realized a transcendental truth: neoclassical economists don't understand neoclassical economics. They instead have a superficial, textbook appreciation of their school of thought, which makes it appear coherent. But in fact deep research, often done by neoclassical economists, establishes that the theory is incoherent. I outline one essential aspect of this--the Sonnenschein-Mantel-Debreu conditions--and show that they are a "proof by contradiction"...

Read More »Australia’s vulnerablity to China

China's successful industrialization was built on export oriented growth polices that enticed Western companies--US in particular--to relocate production to China. Unlike the rest of the developed world, China ensured that it got ownership of the capital as well as employment. But China's recent growth may reflect more of a credit-bubble than export-led or domestic demand led growth, which could make Australia vulnerable to a credit-induced slowdown in China.

Read More »KeenThinkingAboutHousePrices.flv

What REALLY causes house prices to rise? After debunking the standard "population growth" argument, I show that the real motive force for rising house prices is accelerating mortgage debt: for house prices to rise, mortgage debt must not merely increase, but increase more rapidly over time. That requires ever rising mortgage debt compared to income, which of course is impossible. That's why house price bubbles always burst, and the Australian bubble is finally bursting now.

Read More » Steve Keen’s Debt Watch

Steve Keen’s Debt Watch